Expense management is a key responsibility of any business, but it can easily get out of hand without the proper tools. You might be surprised to learn that 82% of companies fail because of poor cash flow management. With so many solutions available, the correct one for your business can save time, avoid errors, and offer you more control over your money. In this article, we will discuss the top expense management software solutions available that can organize your processes, reduce unnecessary costs, and improve your business operations.

What Is Expense Management Software?

These systems automate processes, giving companies accurate data on their expenditures as well as greater control of financial processes. In relieving them of issues such as manual data entry and late reporting of expenses, this software is central to revolutionizing financial processes. Proper expense software addresses chronic problems that plague most organizations with the burden of managing expenditures.

Automatic expense reporting it provides eliminates time-consuming manual processes, greatly minimizing the scope for human error. Real-time tracking features make it possible to track expenses as they occur, so that there is improved control and quicker action against budget issues. Accounting departments, equipped with facilities for creating detailed reports, can analyze expenditures and make decisions based on precise, current information. The most developed solutions offer a complete package of features that will streamline financial procedures.

Automated receipt capture tools now mean businesses need no longer keep using out-of-date, labour-intensive techniques for recording expenditure. Direct scanning into the system limits lost paperwork risk and streamlines the process for submitting expenses. Advanced expense report systems allow seamless tracking and allocation of expenditures and give comprehensive reports detailing all expenditures made, thus presenting companies with an image of their financial behavior.

These sites also facilitate compliance by ensuring that company policies are uniformly enforced to eliminate the occurrence of errors or transgressions. For businesses looking to grow, the advantages of cost management software go beyond short-term process enhancements. It easily integrates with current systems, automates processes, and provides precious time for teams to devote to strategic endeavors. Through its ability to deliver a single point of truth regarding expenses, such platforms efficiently manage resources, facilitate sustainable growth, and ensure fiscal stability.

How To Select The Most Suitable Expense Management Software

Specify Your Business Needs: Set the specific functionality and features your business requires, such as multi-currency support, compatibility with existing accounting software, or mobile access.

Consider User Experience: Choose software with a user-friendly interface that is easy to use by staff and administrators, reducing the learning curve and facilitating adoption.

Assess Scalability: Select software that will scale with your business, managing growing users and more complex expense management requirements as your business grows.

Verify Integration Capabilities: Ensure the software can integrate with your existing tools and systems, including accounting tools, HR software, and payment systems, to automate and prevent data silos.

Review Pricing and ROI: Compare pricing alternatives and determine the potential return on investment (ROI) of the software. Consider the cost savings, time efficiencies, and financial accuracy gains the software can provide to your business.

10 Best Expense Management Software

1. Zoho Expense

Zoho Expense is a cloud-based expense management software designed for businesses of all sizes. With enterprise-level features, it is trusted by many organizations to automate expense report creation, simplify approvals, and provide quick reimbursements. It provides enterprise-level features at affordable prices, though you can first use the free trial and determine whether the software is suitable for your business processes or not.

Key Features

- Assists in scanning receipts easily with auto-scanning and mileage calculation functions

- Facilitates scheduling, creating, and submitting expense reports

- Sends an alert if any company policy is breached

- Facilitates setting auto-approval and auto-rejection rules

- Sends reminders for pending approvals and limits depletion

- Can reimburse using various payment modes such as NEFT, RTGS, IMPS, and ICICI Bank Fund transfer

- Sends instant notification upon completion of reimbursement

- Offers 25+ analytical reports that present a clear snapshot of every penny spent.

Pricing:

- Free ($0)

- Standard ($0.95/month)

- Premium ($1.79/month)

- Custom

2. SAP Concur

SAP Concur is a scalable expense management software with a centralized platform to track and manage employee-initiated expenses. Top US universities and educational institutions are using this tool to save their time and money, stabilize cash flow, conduct AI-powered audits, and remotely manage spending while ensuring compliance during spend and claim management. The software is equipped with an extensive range of features for risks, compliance, data analytics, reporting, and spend management, apart from offering support for integration with other platforms.

Key Features:

- Automated receipt management

- Intelligent categorization

- Foreign currency conversions

- Great integration for credit cards

Pricing: Available on request.

3. Webexpense

Webexpenses, the premier cost management product of Signifo Ltd., combines expense management as well as invoice processing. The laborious, human, and error-prone process of manually posting and tracking expenses is done away with via Webexpenses. Webexpenses is a multinational company that deals in cloud computing software for expenditure and travel administration.

Also, they have a travel and expense mobile app that assists finance teams in managing expenses by enhancing control and visibility of costs and facilitating the process of recording expenses. Furthermore, they provide other services such as payments, invoice processing, and audit that can be used alongside the spending management system.

Key Features:

- A cohesive expense management software

- Their smartphone app enables you to capture, monitor, and keep track of expenses while on the move

- Travel expense policies are integrated into the software system

- The smart technology aligns receipts with the proper credit cards

Pricing: Available on request. A free demo can be booked.

4. Itilite

With its built-in travel and expense management system, ITILITE seeks to enhance employee travel satisfaction while eliminating the necessity for human intervention in processing travel expenses. ITILITE guarantees a remarkable boost in your business’s financial productivity by reducing the time spent tracking, filing, and processing expenses.

Aside from enhancing analytical skills, the trip and Expense (T&E) software system supports automatic audits on receipt compliance and submission of evidence of the trip. As per the ITILITE mobile app, you can organize all your expenses, such as filing for reimbursements, arranging travel, monitoring them, and documenting them.

Key Features:

- The mobile application enables users to reserve upgrades and pay for them same time

- Conveniently handles full travel reservations

Pricing: Available on request.

5. Rydoo

Rydoo is developed to provide a seamless and easy-to-use experience for expense management. The application makes the process of submitting and approving expenses easy and quick for the employees as well as the managers.

Rydoo tools have real-time expense tracking and policy compliance features. Its simple interface and sophisticated expense reporting feature make it an enterprise choice for businesses looking to improve financial efficiency.

Key Features:

- The app possesses a number of features that facilitate expense processing and management, as well as travel.

- It is made to capture mileage and Per Diems

- It combines with other ERP and accounting systems effectively

Pricing:

- Essential ($8/month)

- Pro ($10/month)

Suggested read: Task Management Software

6. Happay

Your travel and expense management will be greatly supported, owing to the entire travel and expense ecosystem provided by Happay in one place. Corporate payments, corporate cards, invoicing, and cash management are also provided. Multiple workflows on one platform are able to be handled by you owing to its end-to-end connectivity, security, full visibility, and control provided by Happay.

Key Features:

- The traditional manual data capture process

- Policy non-compliance challenges

- Delayed approvals

- Lack of spend visibility

Pricing: Available on request.

7. Fyle

Fyle’s onboarding process is rapid and simple. Companies must register, set up policies, and integrate their accounting software. The platform offers user manuals, training, and customer support to aid in onboarding. Staff can report expenses through email, mobile app, or browser extension, making the reporting process easier.

Fyle offers subscription plans starting at $11.99 per month per user, with the price changing based on chosen features and company size. A free trial is made available for firms in a bid to experience the functionality of the platform before deciding to subscribe to it. Advanced services and interfaces cost extra money.

Key Features:

- Offers real-time report updates and notifications

- Allows approval/rejection of expense reports

- Software completely automates policy checks and compliance

- Advanced analytics offers benefits for finance teams

Pricing:

- Growth ($11.99/month)

- Business ($14.99/month)

- Enterprise (custom)

8. ExpenseIn

New functionality and simplicity are combined in ExpenseIn’s expense management software with detailed features and simplicity to optimize the productivity of the expense reporting process.

With features such as automatic compliance with policy, live receipt scanning, and auto-mileage recording, it is valued for turning the time-consuming, paper-based process of expense recording into a fast, computer-based one.

As it is a cutting-edge, hassle-free method of recording expenses, ExpenseIn is the best option for organizations that want the highest efficiency in terms of compliance. In case of any support needed, an instant response is provided, and customer satisfaction is high.

Key Features:

- Professional invoicing

- Enhanced Visibility

Pricing: Available on request.

9. FreshBooks

FreshBooks is a simple-to-use accounting software designed for accountants and small business owners concerned with time, expense tracking, and invoicing. Merging expense management into its accounting function simplifies managing finances and reducing paperwork for users.

FreshBooks, which has a reputation for being extremely user-friendly in design, allows customers to be more organized and money-savvy with tools like professional invoicing, multi-currency support on transactions, and automated payment reminders.

Key Features:

- Professional invoicing

- Comprehensive accounting tools

Pricing:

- Lite ($7.50/month )

- Plus ($12.50/month )

- Premium ($17.50/month )

- Select ( custom pricing)

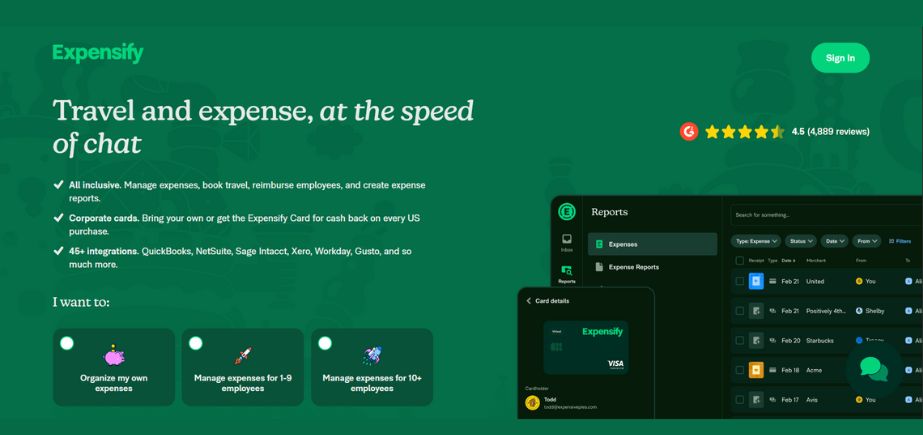

10. Expensify

One of the solutions available to help businesses automate their travel and spending management is Expensify. The simple-to-use expense program offers a Mac and Android application.

Using the mobile app, you can use your phone to take pictures of business expenses like receipts and handwritten bills. With a single click, you can compile and send an expense report. Employees will have a simpler process, and companies will save money using less paper.

Key Features:

- SmartScan feature

- Customized business expense management tool

- Integrates across all Enterprise Resource Planning (ERP)

- The convenience of delegated access

Pricing: Available on request.

Conclusion

In summary, how efficiently your business runs can be significantly influenced by the expense management software you adopt. The solutions we’ve discussed provide you with a range of features that can make reporting simpler, enable you to track your spending, and enhance financial openness.

Spending money on the right software will allow you to reduce errors, save time, and focus on building your business instead of being bogged down in paperwork. By making sure you determine which solution will work best for your needs, you can get closer to better and more efficient cost management.

FAQs

1. What advantages can a software expenditure management solution bring to my company?

These programs allow for compliance with company policies, encourage understanding of expenses, reduce errors in cost reporting, and reduce time devoted to mundane tasks. With faster approval cycles and reduction of wasteful spending, it may also bring cost savings.

2. Is it possible to combine spending management software with my current accounting tools?

Most cost and software management tools have integration with the most commonly used accounting systems, such as SAP, Xero, and QuickBooks. This ensures that data can be easily transferred between systems without involving humans and ensuring proper financial reporting.

3. Is expense management software secure?

Yes, legitimate expense management tools and software companies have robust security practices, including encryption and multi-factor authentication, to guard your financial information. Make sure to select software from a reputable company and confirm their security practices.