The digital economy of the modern world demands payment solutions that are efficient in their use to ensure business organizations of any size remain competitive and able to live up to customers’ expectations. The proper credit card processing software will change how you process transactions, conduct cash flow and expand your business. As a small startup or an established company, it is vital to choose the most suitable credit card processing program to eliminate the time spent on various operations and generate as much revenue as possible.

The new generation of payment-processing systems can do much more than simple transaction conversion; they must include an array of business management support tools, moment-to-moment analytics and integrate with all possible systems.

What is Credit Card Processing Software

This software solution, a complete digital tool, allows businesses to accept and process electronic payments on behalf of customers by using credit cards, as well as debit and other types of payment options. The technology serves as the three-way connector among the merchants and customers and the financial institutions that ensure processing of secure transactions since the data is transmitted efficiently in encrypted form and under authorization in real time. The software normally comprises point of sale terminals, payment gateways, merchant accounts and the backend management system that collaborate and result in smooth payment experiences.

Examples include the recent development of the role of credit card processing platforms, wherein modern platforms are not just transaction handling platforms but also come with additional business management capabilities, including inventory management, customer relationship management and reporting functionalities.

Why Credit Card Processing Software is Important

Having effective payment processing technology has become the key to business success in the modern market, and it impacts everything, both in terms of customer satisfaction and operational performance and financial development.

- Increase in revenue: The ability to receive various forms of payment can improve sales through the ability of company to suit the preferences of various customers.

- Customer Experience: Less complex payment methods stop checkout friction, less waiting time, and offer easy payment methods.

- Security Compliance: Built-in encryption and other anti-fraud security options are in place that keep sensitive financial information safe and keep a business and its consumers in compliance with the PCI standard.

- Optimum Efficiency: The processing of transactions automatically, real-time reporting, and multifunctional inventory management erases manual work, fewer human errors.

- Competitive Advantage: Contemporary payment abilities are a sign of professionalism, customer confidence, and a competitive advantage to the enterprises.

Essential Features to Look for in Best Credit Card Processing Software

In comparing payment processing platforms, some basic features distinguish outstanding services from mere platforms that process transactions primarily.

- Multi-Payment Support: Payments that are supported: credit card, debit card, mobile wallets, and contactless payment.

- Security Features: Enhanced encryption standards, tokenizing tools, fraud detection software of fraud, PCI DSS, to secure important data.

- Integration Capabilities: Incorporation with the rest of the business’s systems, such as accounting programs, inventory management systems and CRM.

- Real-Time Analytics: The extensiveness of reporting dashboards, transaction observation, sales analytics, and performance indicators that can be used to take actions.

- Cross-platform and mobile compatibility: The capability to accept payments on the move across all devices, including smartphones, tablets, and mobile POS, to achieve the much-needed flexibility in receiving payments.

Comparison Table for Best Credit Card Processing Software

| Name | Rating | Best Feature |

| Stripe | 4.8/5 | Developer-friendly API integration |

| Square | 4.7/5 | All-in-one business management |

| PayPal | 4.6/5 | Global payment acceptance |

| Helcim | 4.9/5 | Transparent interchange-plus pricing |

| Clover | 4.5/5 | Customizable POS hardware |

| Stax | 4.7/5 | Subscription-based pricing model |

| Worldpay | 4.4/5 | Enterprise-level processing volume |

| Shopify Payments | 4.6/5 | E-commerce platform integration |

| Authorize.Net | 4.3/5 | Established merchant services |

| Adyen | 4.8/5 | Global omnichannel platform |

Top 10 Best Credit Card Processing Software

1. Helcim

Rating: 4.9/5

Website: https://www.helcim.com

Best Use Cases: Small to medium businesses seeking transparent pricing and customer service excellence

The best payment processing system that applies to the needs of the smaller and middle sized businesses which center on transparent pricing policy and customer services is Helcim. It is priced on interchange-plus without any additional fees and requirements on how many dollars a month are required, and it has no term and, therefore, a favourable choice for business owners to expand their boundaries. As part of the best credit card processing software options available, Helcim hopes that its clients will prosper, and this can be justified by the fact that it equally provides them with excellent support that is offered at no charge in terms of onboarding and account management.

The payment can be powerfully processed through the software in any channel, such as online payment, face-to-face payment and mobile payment. The most convenient fraud protection, available in real-time reports and integrated with other programs by Helcim or the ability to incorporate other programs to give the enterprise features in the most convenient way possible at the lowest cost that small businesses need, is what they offer.

Key Features:

- Interchange-plus pricing

- Multi-channel processing

- Top-tier fraud protection

- Real-time reporting

- Free customers service

Pros:

- Open pricing system

- It does not charge monthly fees.

- Quality customer services

Cons:

- Slim foreign processing

- Reduced merchant channel

- minor characteristics of greater worth

Pricing: Interchange + 0.40% + $0.08 per transaction

2. Stripe

Rating: 4.8/5

Website: https://stripe.com

Best Use Cases: Developers and businesses requiring extensive API customisation and global payment capabilities

Stripe payment processing is an innovation in the sense that this web-based payment system is developer-friendly and has its APIs well defined structure, which provides companies with the chance of coming up with their own payment experience. As part of the best credit card processing software options in the market, Stripe supports more than 135 national currencies and payment systems, making it the most appropriate platform for firms with an international venture, scattered operations, or a global customer base.

Stripe system documentation is also powerful, and with a robust integration capability, most developers can easily create even sophisticated payment flows, subscriptions, and even marketplace applications.

On implementation, the application would be able to perform multilingual payments, party-based transactions, machine payments and revenue maximisation application. The fact that fraud identification is accepted on the basis of machine learning can assist business entities to be even more efficient in their decisions and to achieve the most eye-catching heights of security connected with the process of payment processing.

Key Features:

- Developer-friendly APIs

- Foreign support in terms of payment

- Machine learning fraud detection

- Subscription Billing Service

- Revenue optimization tools

Pros:

- High quality of customization

- Global payments insurance

- High-performance development tools

Cons:

- Aspects of poor setup process

- More learning curve

- Little by way of telephonic service

Pricing: 2.9% + $0.30 per successful charge

3. Square

Rating: 4.7/5

Website: https://squareup.com

Best Use Cases: Small businesses and retailers needing integrated POS systems and business management tools

In addition, Square’s innovative business model rocked the payment processing sector of the small business laboratory through a one-stop management solution. Through its interface, customers relate the point of sale equipment, payment handling, inventory systems, and its relationship services easily. As one of the best credit card processing software options available today, the Square ecosystem can be defined as a bundle of solutions to restaurants, retail networks, stores, service institutions, and e-commerce stores specializing in the industries under discussion.

The interfaces of this software are user-friendly, and therefore, the software can easily be used even where the owners of the business are not technically minded. With the in-built analytics, automatic reporting, as well as marketing tools, Square is meant to be more effective to meet the demands of a small business so as to make it efficient and customize all customers with an efficient experience of all touch points in payment.

Key Features:

- Prefix POS systems Built-in systems

- Control tools in management

- CRM Customer relationship management

- Functionality of marketing automation attributes

- Industry-specific solutions

Pros:

- User-friendly interface

- Corporate tool kit

- No monthly subscription charge

Cons:

- Higher prices of the transaction Fee

- Deficiency of features in customization

- Normative reporting capability

Pricing: 2.6% + $0.10 per tap, dip, or swipe

4. Stax

Rating: 4.7/5

Website: https://www.stax.com

Best Use Cases: High-volume businesses seeking subscription-based pricing to minimise per-transaction costs

Stax became the first business venture that led to establishing the subscription-based payment processing program by offering a percentage of fee program to business entities at a low-cost alternative. As one of the best credit card processing software options available, some of the merchants who will benefit largely from this developed strategy will be the high-volume merchants who will save money in terms of membership fees, as they will be charged monthly rather than spending money on per-transaction charges. The platform provides a complete ability to transact anywhere and everywhere online, via mobile, and in-store, in addition to enabling extra protection and fraud security customisations.

Stax emphasises price and contract transparency, and foregoes all secrecy pricing and allowing businesses to have a definitive price for payment processing. The software will be highly furnished in terms of reporting, possibility to integrate with the API and even provide a dedicated customer support that could enable merchants to optimise their payment processes as well as continue delivering an outstanding customer service.

Key Features:

- Pricing model of subscription type

- Multi-channel payment facility

- High level security

- Clear fee policy

- Api integration functionality

Pros:

- Sharp monthly expenses

- No percent costs

- Transparent pricing

Cons:

- Membership needed on monthly basis

- Restricted towards low-volume enterprises

- Complicated price levels

Pricing: $99-$199 monthly membership + interchange rates

5. PayPal

Rating: 4.6/5

Website: https://www.paypal.com

Best Use Cases: E-commerce businesses and international merchants requiring global payment acceptance and buyer protection

PayPal is the most popular and efficient payment processing site and it is known that the business has a capacity of reaching millions of active customers in all corners of the globe. In characteristics of buyer and seller protection programs that instil confidence in the online buy and reduce the risks of chargebacks, the platform is rather appealing. The great presence across the international markets also enables the PayPal companies to accept various currencies and open the global market with the least complications.

The software is flexible concerning integration, whereby it offers varied choices like simple application of buttons, streamlined checkout process, and incorporation with the entire e-commerce package. With PayPal Credit, express payments, and subscription billing, businesses can achieve flexibility in payments that enhances customer satisfaction percentages and conversion with the frequent payment terms at low security liability.

Key Features:

- Payment acceptance in the world

- Protection to buyers programs

- Various integrative possibilities

- Currency converting services

- Flexible pay plans

Pros:

- Worldwide recognition

- Reliable consumer security

- Easy implementation

Cons:

- Possible account holds

- Increased foreign charge fees

- Limited customization

Pricing: 2.9% + $0.30 per transaction for online payments

6. Shopify Payments

Rating: 4.6/5

Website: https://www.shopify.com/payments

Best Use Cases: E-commerce businesses using Shopify platform seeking seamless integration and unified payment management

Shopify Payments is a specially constructed payment provider that is purposely designed or built to work with the Shopify e-commerce platform and is perfectly integrated and managed out of the box. It does not involve the use of third-party payment gateways; hence, it provides an in-built processing, which works in the final regalia along with the management tools of the Shopify store. With such a kind of integration, the merchants will be able to obtain effective analytics, refund and even contest management in the Shopify dashboard.

It supports multi-payment options, including credit card networks, online wallets and domestic payments, hence the businesses are able to access the worldwide market of clients. The most cost-friendly payment processing without additional transaction fees imposed on the owners of the Shopify store, optimal fraud prevention procedures, and the highest level of security are provided by the solution.

Key Features:

- Native Shopify connections

- Integrated dashboard control

- Worldwide forms of payment

- Integrated fraud protection

- Comprehensive analytics

Pros:

- Streamless Shopify connection

- There are no extra charges on transacting

- Comprehensive reporting

Cons:

- Available to those using Shopify only

- Less customization Fewer customization options

- Principal fraud prevention

Pricing: 2.9% + $0.30 per online transaction

7. Clover

Rating: 4.5/5

Website: https://www.clover.com

Best Use Cases: Retail and restaurant businesses requiring customizable POS hardware with advanced business management features

To provide a point of sale with complex business management software that allows extreme customisation of hardware centres, Clover has a competitive edge in the market. With the solution giving a choice of types of hardware at various scales of application in smaller card reader systems to the full POS systems, businesses are given the choice of equipping their businesses with the equipment that best suits their specific business needs. Clover app marketplace provides immense customisation, as with third-party features, they include features of inventory management apps, employee scheduling, customer loyalty and point programs, and industry-specific apps.

Reporting features of the program are extensive, including sales analysis in real time and an integrated payment system that streamlines business affairs. Using the optimal security and customer support platforms, Clover assists companies in developing simplified, accountable payment experiences and remaining in complete control of the manner in which their work processes operate.

Key Features:

- Configureable hard POS equipment

- Large app store

- Powerful reporting programs

- Industry-specific solutions

- Combined management in business

Pros:

- Portable hardware choices

- Affluent app ecosystem

- Ultra business tools

Cons:

- More expensive equipment

- Complicated set up procedure

- Software monthly payment

Pricing: 2.3% + $0.10 per transaction + monthly software fees

8. Worldpay

Rating: 4.4/5

Website: https://www.worldpay.com

Best Use Cases: Large enterprises and high-volume merchants requiring global processing capabilities and advanced security features

Worldpay is a multi-functional payment system that is most suitable for large organisations and even high-traffic-level merchants that require international billing and enterprise-inspired security measures. Most of the countries and currencies can do transactions on the site, which accepts billions of transactions annually, providing businesses with the base to expand their operations to foreign shores and globalised payment scenarios. The advanced ATP solutions that Worldpay has successfully introduced at the moment use the principles of the machine learning approach and real-time risk evaluation to keep the customer journeys uncomplicated and fraud-free transactions on the merchant side.

Key Features:

- Abilities that can process globally

- Enterprise-level security

- An early warning of fraud Prevention

- A lot of integrate ability

- Devoted account management

Pros:

- Global reach

- Enterprise-grade security

- High-volume capacity

Cons:

- Complicated pricing formulation

- Long contract terms

- Increased minimum standards

Pricing: Custom enterprise pricing based on volume and requirements

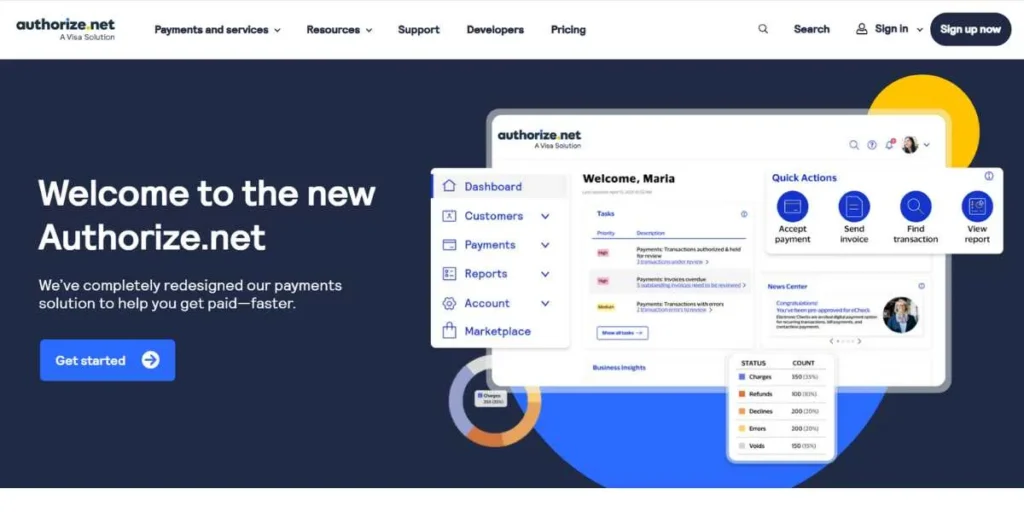

9. Authorize.Net

Rating: 4.3/5

Website: https://www.authorize.net

Best Use Cases: Established businesses requiring reliable payment gateway services with extensive integration support and developer resources

Authorize.Net is a well-trusted company that offers India payment gateways, and it has an excellent history of two decades, when it comes to providing stable payment gateways to businesses operating in various fields. It has a high-performing payment gateway feature, which acts well with the merchant account, business applications, with a lot of APIs and integration features. There are multi-payments available in the form of a credit card payment, an e-Check payment, and a digital payment with high-security systems and fraud detection in Authorize.Net. Customer data management, recurring payment billing, and detailed payment transaction reports are availed by the programs and assist in settling down the payment process by businesses.

Key Features:

- Dependable payment gateway

- Coverage of API documentation

- Fraud-Monitoring software

- Recurring billstructures

- Customer information managing

Pros:

- Proven reliability

- Comprehensive documentation

- Sharp developer support

Cons:

- Non intuitive user interface

- Increase in transaction charges

- Difficult install procedure

Pricing: $25 monthly

10. Adyen

Rating: 4.8/5

Website: https://www.adyen.com

Best Use Cases: Global enterprises and omnichannel retailers requiring unified payment processing across multiple markets and channels

Adyen provides a global payment solution that enables international enterprises to make payments on any channel and in any market through a single integration, which makes international payment transactions a very complex process. It has over 250 types of payment, and it is applied in over 150 currencies, and hence believed to be a reasonable platform for a business with a diverse global customer base. Omnichannel payment experience that Adyen offers ensures that the payment experience is the same whether one shops online, in-store, or using the mobile applications, and the data across all touchpoints will be synced in real-time. The software offers advanced analytics, revenue optimisation and machine learning based fraud to help the company optimise its business conversion with the minimum number of risks involved.

Key Features:

- Online / offline integration

- International transaction mechanisms

- Revenue maximization devices

- Fraud prevention in machine learning

- Face to face networks

Pros:

- International coverage of payment

- Unified platform technique

- Advanced analytics

Cons:

- Enterprise-focused pricing

- Complex implementation

- Large minimum totals

Pricing: Custom enterprise pricing with interchange-plus model

How to Choose the Best Credit Card Processing Software

When choosing the most suitable payment processing solution, one should pay much attention to a variety of factors which directly influence your business work, clients’ experience and future perspectives of your company.

- Business needs: Evaluate your unique payment processing requirements, such as volume of transactions, average order size, international requirements and integration requirements.

- Pricing Structure: Swap various fee structures such as flat-rate, interchange-plus and subscription-based pricing and identify the best pricing that fits best on your conviction over your business transaction pattern.

- Security Standards: Check the system’s security features of this platform such as PCI DSS compliance, etc., encryption protocols etc.,and tokenisation abilities.

- Integration Capabilities: Look at the extent to which the payment processing software integrates with other compatible tools of your own business, such as accounting systems.

- Customer Support: Take into consideration customer support services such as onboarding services, technical customer support channels, quality, and availability.

Conclusion

The use of the most appropriate payment processing solution greatly affects business success, customer satisfaction and efficiency in the field in the present competitive marketplace. The best Credit Card Processing Software balances within itself safe transaction processing features, a full business management package and a high integration potential in order to enable you to achieve your growth aims. Regardless of whether you focus on simple and transparent pricing (as Helcim does), developer-friendly features (as is the case with Stripe), or on all-in-one services (as Square proposes), each of these platforms has specific features and benefits that are valuable to particular companies.

FAQs

How much does a credit card processing software cost on average?

The majority of the providers have fees that are between 2.3 per cent- 3.5 per cent of the transaction, and small fixed fees are $0.10 to $0.30, whereas others have subscription-based models with the starting cost of around $99 a month.

How long does it take to implement credit card processing?

Basic accounts are normally set up in 1-3 business days, whereas larger enterprises can take several weeks, depending on how much integration is needed, as well as business verification steps.

What are the security measures I need to emphasise?

Key security options are PCI DSS compliance, end-to-end encryption, tokenisation, fraud detection algorithms, and safe data storage to secure sensitive customer data.

Am I able to change payment processors?

The majority of modern processors provide migration help and flexible contracts, so you will need to look through the paragraphs covering termination clauses and integration complexity to plan a change of providers.

Will I need a separate online and in-store payment software?

Most providers have developed a single solution to cover both online and face-to-face transactions with the integration of systems and avoid the necessity of using two systems; such solutions make management much simpler.