Accurate accounting is important for e-commerce vendors to control finances, monitor expenses, and maintain tax compliance. Good accounting software makes bookkeeping, inventory, invoicing, and GST return filing easy, and financial transactions simple. The software is essential for online retailers, dropshippers, and marketplace vendors who require automated tools to deal with high transaction volumes.

The top 15 accounting software for e-commerce sellers are selected based on ease of use, support for e-commerce integration, tax compliance, automation, and cost. They are intended for entrepreneurs, business owners, and accountants who need to automate finances with a growth focus. The guide names the best e-commerce accounting software in order to enable sellers to select an appropriate solution that caters to their own requirements.

Criteria for Selecting Accounting Software for E-commerce Sellers

1. Integration of e-commerce: Seamless integration with Amazon, Shopify, WooCommerce, and eBay to synchronize transactions and stock.

2. AI & Automation Functionality: Automated reconciliation, expense tracking, and invoicing minimize manual effort and errors in accounting.

3. Compliance and GST Filing: Multi-region tax laws such as GST, VAT, and sales tax are managed to adhere to the rules.

4. Payment Gateway Support: Support for multiple currencies and e-commerce payment gateway integration, for instance, PayPal, Stripe, and Razorpay is highly critical for foreign sellers.

5. Order & Inventory Management: Reconciliation of orders and inventory management functionalities built into the software ensure stock levels and operational effectiveness.

6. Simple Interface: Easy, easy-to-use interface ensures that even accountants are not required to manage the finances.

7. Scalability & Pricing: The software should be within reach for small businesses with more advanced features open to expanding companies.

8. Reporting & Analytics: In-depth financial reports, profit & loss reports, and sales reports enable sellers to make informed decisions.

9. Mobile Accessibility: A mobile app enables sellers to access finances on the move.

10. Customer Support & Community: Strong customer support and user community enable troubleshooting and usability.

Considering these, e-commerce sites can opt for the most appropriate accounting software to make financial management easy and aid in business growth.

Top 15 Best Accounting Software for E-commerce Sellers

1. Tally.ERP 9

Tally.ERP 9 is a comprehensive accounting and inventory control software extensively employed in India. It has GST compliance, billing, payroll processing, and accounting reporting. Famed for being offline-friendly, it serves small and medium-sized businesses. Despite its plethora of features, it boasts an old-fashioned look and needs training. Its single-installation pricing renders it inexpensive for enterprises searching for a comprehensive accounting system.

Key Features:

- GST filing and reconciliation

- Multi-currency support

- Inventory and stock management

- Banking and payment tracking

- Customizable invoicing

Pros:

- Trusted by Indian businesses

- Strong GST compliance features

- Offline usability

Cons:

- Dated UI and steep learning curve

- Limited cloud access

Pricing:

Starts at ₹22,500 (one-time) and ₹ 750 +18% GST (₹ 135)

Who Should Use It?

Small to medium-sized businesses requiring offline accounting and GST filing.

2. Zoho Books

Zoho Books is a cloud accounting application meant for small and medium enterprises. It streamlines invoicing, expense management, tax return filing, and bank reconciliation. It has an easy-to-use interface, offers affordable prices and can easily be integrated with other Zoho apps. It has multi-user collaboration and mobile access capabilities. Though perfect for new ventures, more sophisticated features such as inventory management are found on more advanced plans.

Key Features:

- Automated invoice and expense tracking

- Multi-channel sales integration

- Bank reconciliation

- GST filing and tax compliance

- Mobile Accessibility

Pros:

- User-friendly interface

- Affordable pricing

- Strong automation features

Cons:

- Limited third-party integrations compared to competitors

- Advanced features available only in higher plans

Pricing:

Starts at ₹899/month

Who Should Use It?

Startups and small businesses looking for cost-effective cloud accounting.

3. QuickBooks Online

QuickBooks Online is a worldwide popular cloud accounting solution that provides automated invoicing, reconciliation of banks, cash flow management, and tax compliance. It can integrate with many third-party applications and thus is suitable for expanding businesses. QuickBooks, though, shut down its operations in India in 2023, restricting its usability for domestic businesses. It is still an expensive solution despite its strong automation and is outpriced by local solutions.

Key Features:

- Automated invoicing and expense tracking

- Multi-user collaboration

- Inventory and cash flow management

- Bank and payment gateway integration

- Tax calculation and compliance

Pros:

- Intuitive UI

- Scalable for growing businesses

- Strong integration capabilities

Cons:

- Costlier than local alternatives

- Limited support in India after discontinuation in 2023

Pricing:

Monthly subscription available

Who Should Use It

Businesses operating outside India or those needing a global accounting solution.

4. Vyapar

Vyapar is a low-cost and easy-to-use accounting software for small enterprises and retailers in India. It provides GST invoicing, inventory tracking, and sales monitoring with offline support. The mobile and desktop availability makes it easy for entrepreneurs. Though easy to use, it does not have high-end features and integrations that are available in premium accounting tools, making it ideal for basic accounting requirements.

Key Features:

- GST invoicing

- Inventory and stock tracking

- Offline functionality

- Mobile and desktop access

- Expense and sales tracking

Pros:

- Budget-friendly

- Easy to use for non-accountants

- Works offline

Cons:

- Limited integrations

- Basic features compared to larger competitors

Pricing:

Starts at ₹3599.10/year

Who Should Use It?

Small retailers and e-commerce sellers looking for a simple, affordable solution.

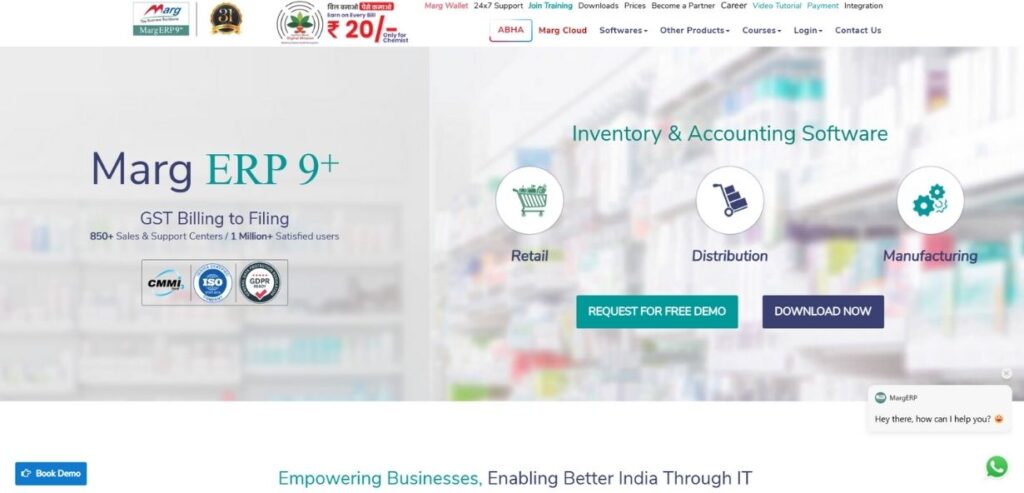

5. Marg ERP

Marg ERP is a feature-rich inventory management and accounting software used by wholesalers, retailers, and manufacturers. It has GST compliance, barcode reading, payroll handling, and integration with e-commerce. Highly configurable, it is suitable for organizations with massive inventories and distribution chains. But its complex setup and learning process requires training. It is ideal for organizations needing high inventory and supply chain control.

Key Features:

- GST compliance

- Inventory and supply chain management

- E-commerce integration

- Barcode scanning

- Payroll processing

Pros:

- Feature-rich for retail and wholesale businesses

- Highly customizable

- Strong distribution management

Cons:

- Complicated setup

- Requires training

Pricing:

Starts at ₹8991/year(one-time)

Who Should Use It?

Wholesale and retail businesses need inventory-heavy accounting.

6. ProfitBooks

ProfitBooks is cloud accounting software that is specifically designed for small enterprises and startups. It offers GST-compliant invoices, expense recording, bank reconciliation, and stock management. Its easy-to-use interface and automated features make bookkeeping easy. Although it has a free basic plan, enhanced features are present in paid versions. It suits startups and emerging businesses seeking an easy-to-use cloud accounting program.

Key Features:

- GST invoicing

- Expense tracking

- Bank reconciliation

- Multi-user access

- Cloud storage

Pros:

- Simple and beginner-friendly

- Good automation features

- Cloud-based access

Cons:

- Limited advanced features

- Fewer integrations than competitors

Pricing:

Free basic plan; paid plans start at ₹749/month

Who Should Use It?

Small businesses and startups need an easy-to-use accounting solution.

7. Refrens

Refrens is a basic invoicing and accounting software suitable for freelancers, agencies, and small enterprises. It has GST-compliant invoicing, payment tracking, and client management. The tool has a free plan with core features, which makes it an affordable option. Although good for invoicing, it does not have complete accounting features suitable for complex businesses. It is ideal for freelancers and service-based companies.

Key Features:

- Invoice generation

- Client and payment tracking

- GST-ready

- Multi-user access

- Freelance and agency management

Pros:

- Free plan available

- Simple UI

- Good for freelancers and small agencies

Cons:

- Not feature-rich for complex accounting

- Limited reporting tools

Pricing:

Free basic plan; paid plans start at ₹4700/year

Who Should Use It?

Freelancers and small agencies looking for invoicing and accounting.

8. WebLedger

WebLedger is an Indian cloud accounting software that is geared towards Indian companies. It has GST invoicing, bank reconciliation, and financial reporting. It is easy to book-keep and easy to stay compliant with tax requirements through its multi-user support. It is affordable and suitable for small businesses, although it does not have high-end automation and integration like the bigger players. It’s perfect for those who want a light, affordable cloud accounting service.

Key Features:

- GST invoicing

- Multi-user collaboration

- Bank reconciliation

- E-commerce integrations

Pros:

- Affordable pricing

- Customizable reports

- Cloud-based

Cons:

- Limited advanced accounting features

- UI could be more modern

Pricing:

Contact for pricing

Who Should Use It?

Small e-commerce sellers needing budget-friendly cloud accounting.

9. Easy GST

Easy GST is an easy-to-use accounting software used for GST billing and compliance by Indian businesses. It provides invoicing, tracking of sales, and multi-user functionality. It is low in cost, which makes it a great option for businesses that need basic accounting functionality. It lacks advanced reporting and integration capabilities, which limits its scalability. Perfect for small businesses looking for an easy, low-cost GST filing solution.

Key Features:

- GST billing and return filing

- Inventory and sales tracking

- Multi-user support

Pros:

- Affordable

- Simple GST compliance

Cons:

- Limited beyond GST features

- Not suitable for complex businesses

Pricing:

Starts at ₹1500 for lifetime

Who Should Use It?

Businesses focusing on GST compliance with basic accounting needs.

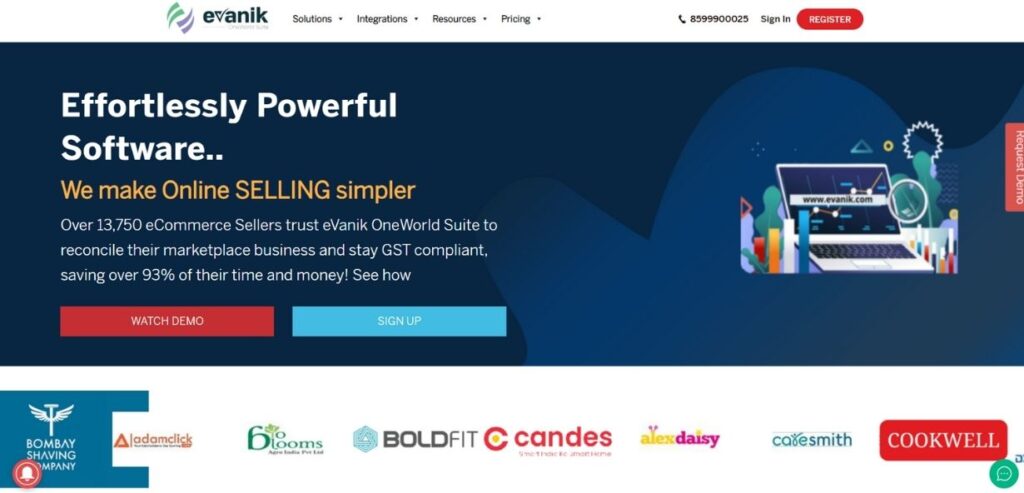

10. eVanik OneWorld Suite

eVanik OneWorld Suite is an inventory management and accounting software built specifically for e-commerce companies. It supports various online marketplaces, reconciling payments automatically, GST compliance, and stock management. Although feature-packed, it costs more than traditional accounting software. It is suitable for medium and large e-commerce sellers with multiple sales channels and needs automation of order processing.

Key Features:

- Multi-channel order management

- Payment reconciliation

- Automated GST filing

- Inventory tracking

Pros:

- Built for e-commerce

- Supports multiple marketplaces

- Strong automation

Cons:

- Expensive for small businesses

- Requires learning curve

Pricing:

Contact for pricing

Who Should Use It?

Medium to large e-commerce sellers managing multiple channels.

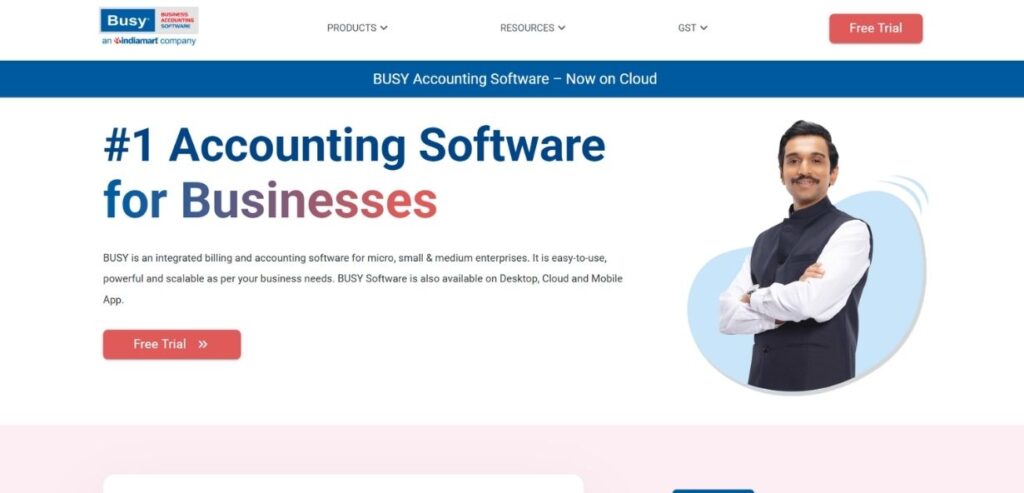

11. Busy Accounting Software

Busy Accounting Software is an India-specific accounting software that provides GST compliance, inventory management, and payroll processing. It offers robust financial reporting capabilities and is therefore a favorite among SMEs. The one-time pricing makes it affordable, yet the interface is dated compared to cloud-based software. It is ideal for businesses that require offline accounting with powerful inventory and tax management.

Key Features:

- GST invoicing and filing

- Inventory and stock tracking

- Payroll management

- Multi-currency support

Pros:

- GST compliance

- Inventory management

- One-time pricing

Cons:

- Old-school UI

- Limited cloud access

Pricing:

Starts at ₹7,200 (one-time)

Who Should Use It?

SMEs requiring offline accounting with GST compliance.

12. Giddh

Giddh is cloud accounting software that comes with automation and API integration. It supports GST invoicing, bank reconciliation, financial reports, and multi-users. It is designed for SMEs and allows customizable reports as well as real-time financials. Though it is powerful, its market visibility is increasing gradually, and there is a learning curve required. It is perfect for organizations that require cloud accounting with customized integrations.

Key Features:

- GST compliance

- Bank reconciliation

- Multi-user access

- API integrations

Pros:

- Cloud-based

- Customizable reports

Cons:

- Limited market presence

- Learning curve

Pricing:

Free trial & starting at ₹4000/ year

Who Should Use It?

Tech-savvy SMEs needing custom integrations.

13. Book Keeper

Book Keeper is an easy and low-cost accounting program for freelancers and small companies. It offers GST invoicing, expense management, and synchronization across multiple devices. The program is easy to use, even for beginners, with a user-friendly interface. It does not offer advanced features such as payroll and in-depth financial reporting. It is ideal for startups and sole business owners seeking a lightweight, low-cost accounting program.

Key Features:

- GST invoicing

- Expense tracking

- Multi-device sync

Pros:

- Affordable

- User-friendly

Cons:

- Limited advanced features

- No Extensive Integrations

Pricing:

Starts at ₹2,500/year

Who Should Use It?

Freelancers and small businesses need basic accounting.

14. ClearTax

ClearTax is an accounting software with a focus on tax compliance, providing GST return filing, invoicing, and tax calculation. It makes tax filing easy for businesses and individuals alike, with accurate reporting. Though it is strong in compliance, it does not have advanced accounting and inventory management capabilities. Its pricing is also greater for small businesses. It is best for businesses and professionals who are mainly concerned about tax compliance and GST filing.

Key Features:

- GST return filing

- Invoicing and expense tracking

Pros:

- Strong tax features

- User-Friendly Interface

Cons:

- Expensive for small businesses

- No Inventory Management

Pricing:

Contact for pricing

Who Should Use It?

Businesses focused on GST compliance.

15. HostBooks

HostBooks is cloud accounting software that has AI-enabled automation for invoicing, GST filing, and bank reconciliation. It offers real-time financial reporting and compliance management. Although it has robust automation, it comes at a premium price, and hence it’s more appropriate for mid-sized organizations than small-scale startups. It is ideal for companies that need automated accounting and tax compliance with AI-enabled efficiency.

Key Features:

- GST invoicing

- Bank reconciliation

Pros:

- AI automation

- Cloud-Based Accessibility

Cons:

- Expensive for small users

- Limited Market Reach

Pricing:

Contact for pricing

Who Should Use It?

Medium-sized businesses needing automation.

Comparison Between Accounting Software for E-commerce Sellers

Here’s a comparison table of the top accounting software for e-commerce sellers, based on key features, pricing, integrations, and best use cases:

| Software | Key Features | E-commerce Integrations | Pricing | Best For | Website |

| Tally.ERP 9 | GST compliance, inventory management, automation | Limited (via third-party apps) | INR 750+18% GST (INR 135) | Indian businesses needing offline accounting | tallysolutions.com |

| Zoho Books | Automated invoicing, tax compliance, reporting | Shopify, Amazon, WooCommerce | Free & Starts at ₹899/month | Small businesses & startups | zoho.com/books |

| QuickBooks Online | Cloud-based accounting, multi-currency, invoicing | Shopify, eBay, Amazon | Monthly subscription | Growing e-commerce stores | quickbooks.intuit.com |

| Vyapar | GST billing, stock management, invoicing | No direct integrations | Free & Starts at ₹3599.10/year | Small Indian businesses | vyaparapp.in |

| Marg ERP | Inventory, payroll, POS, GST filing | Limited (requires customization) | Starts at ₹8991/year | Retail & wholesale businesses | margcompusoft.com |

| ProfitBooks | Cloud-based accounting, inventory, invoicing | No direct integrations | Free & starting at ₹749/month | Startups & small businesses | profitbooks.net |

| Refrens | Freelance invoicing, expense tracking | No direct integrations | Free and starting at ₹ 4,700 | Freelancers & small sellers | refrens.com |

| WebLedger | Cloud-based accounting, multi-user support | No direct integrations | Contact for pricing | Businesses needing multi-user support | https://webledger.in/ |

| Easy GST | GST filing, invoicing, tax reports | No direct integrations | Free & Starts at ₹1500 for lifetime | Indian businesses needing tax solutions | https://www.easy-gst.in/ |

| eVanik OneWorld Suite | Automated reconciliation, GST filing, reports | Amazon, Flipkart, Paytm, eBay | Contact for pricing | Marketplace sellers | evanik.com |

| Busy Accounting Software | Inventory, financial reports, tax compliance | Limited (requires add-ons) | Starts at ₹7,200 (one-time) | Small & medium enterprises | https://busy.in/ |

| Giddh | Cloud-based, real-time data sync, reporting | Shopify, WooCommerce | Free trial & starting at ₹4000/ year | Businesses needing real-time analytics | giddh.com |

| Book Keeper | Cloud & offline accounting, invoicing, reports | No direct integrations | Starts at ₹2500/year | Small businesses & freelancers | bookkeeperapp.net |

| ClearTax | GST compliance, tax filing, invoice automation | No direct integrations | Contact for pricing | Indian sellers needing tax filing | cleartax.in |

| HostBooks | Cloud accounting, GST & TDS compliance, automation | Limited integrations | Contact for pricing | Medium to large enterprises | hostbooks.com |

This table helps choose the best accounting software for e-commerce sellers based on their needs, whether for tax compliance, automation, or integrations with online marketplaces.

Conclusion

Choosing the right accounting software for e-commerce sellers is important for vendors to deal with finances efficiently, stay tax-compliant, and automate transactions. The best software depends on the size of the business, integration needs, and price. For small businesses and new ventures, Zoho Books and QuickBooks Online offer easy-to-use cloud-based solutions with automated features. Vendors in India can use Tally.ERP 9, Vyapar, and ClearTax, which have robust GST compliance and invoicing features.

Large businesses and marketplace sellers may choose Evonik OneWorld Suite or HostBooks for advanced reconciliation and auto-reporting. Freelancers and sole proprietorships may utilize Refrens and Book Keeper for simple invoicing and expense tracking.

Businesses needing integration with WebAR may use Giddh or Busy Accounting Software. Businesses needing offline accounting with strong inventory management can choose Marg ERP. Lastly, selecting the best accounting software for e-commerce sellers depends on the volume of transactions, tax obligations, and integration requirements in an effort to achieve efficiency and business growth.

FAQs

1. Why do e-commerce sellers use accounting software?

E-commerce sellers receive huge volumes of transactions, adhere to tax regulations, and monitor inventories. Accounting software undertakes these jobs automatically, producing accurate results, financial tracking, and efficient company operations.

2. Which is the best accounting software for e-commerce sellers?

Zoho Books, QuickBooks Online, and ProfitBooks are excellent options for small businesses because they have simple interfaces, automation capabilities, and compatibility with online marketplaces.

3. Do accounting tools have compatibility with e-commerce websites?

Yes, several accounting tools such as QuickBooks Online, Zoho Books, and eVanik OneWorld Suite are compatible with Shopify, Amazon, Flipkart, WooCommerce, and other e-commerce websites for hassle-free tracking of transactions.

4. Is free accounting software for e-commerce sellers available?

Yes, certain software such as ProfitBooks, Vyapar (starter version), and Refrens provide free versions with limited functionalities ideal for small sellers and startups.

5. What is the best accounting software for GST compliance?

Tally.ERP 9, ClearTax, Busy Accounting Software, and HostBooks offer robust GST compliance functionality, which makes them suitable for companies doing business in India.