An e-commerce world is growing and therefore requires an authentic and secure payment service for success. The right payment gateway usually determines the immediate experience of a customer in conversion and, as a result, business growth. This article delves into 12 of the best eCommerce payment gateways available, from the transaction fees, supported payment methods, security features, and ease of integration.

Types of eCommerce Payment Gateways

E-commerce payment gateways may be broadly categorized as:

- Hosted Payment Gateways: These direct customers to the payment gateway’s secure server for completing transactions. Examples include PayPal and Square.

- Integrated Payment Gateways: These integrated payment gateways are directly put on the merchant’s website so that customers face fewer steps when making a transaction. Examples are Stripe and Authorize.Net.

How do eCommerce Payment Gateways Work?

- Customer initial Payment: The customer chooses products on the merchant’s website and then checks out.

- Payment Information Submission: The customer enters their payment information such as a card number, CVV, etc., on the interface provided by a payment gateway.

- Transaction Processing: The payment gateway communicates with the customer’s bank to seek verification of the transaction and approve the payment.

- Funds Transfer: If the transaction is accepted, then funds will be transferred from the customer’s account to the merchant’s account.

- Confirmation of Order: The customer gets an order confirmation and the merchant receives payment confirmation.

12 Best eCommerce Payment Gateways

Here’s a list of top 12 payment gateways for 2025.

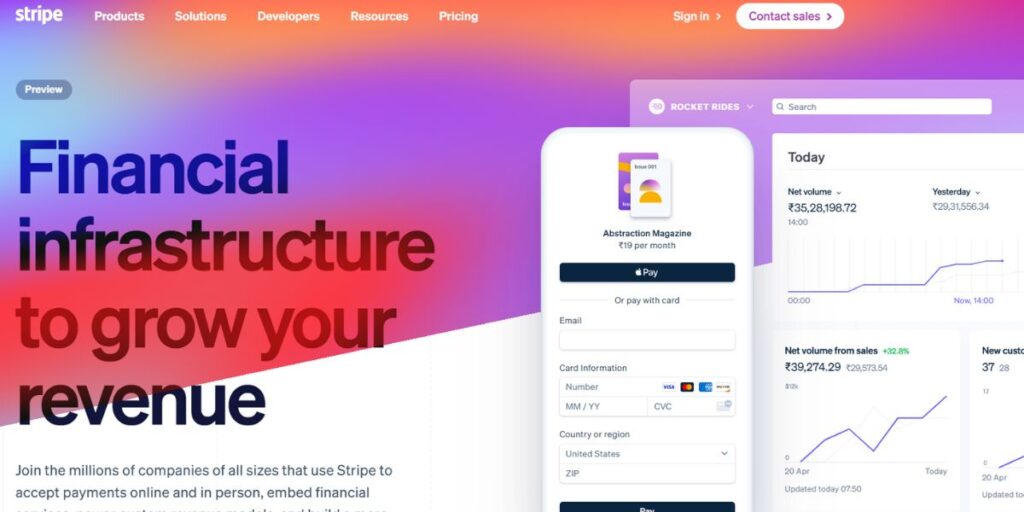

1. Stripe

- Rating: 4.9/5

- Best For: Large organizations and tech-inclined businesses

Stripe is the gold standard for best eCommerce payment gateways. They offer a strong platform that is easy to integrate with a wide range of programming languages and frameworks. It is a great choice for businesses that need customized payment solutions because it is developer-friendly, has good documentation, and offers flexible APIs.

The platform supports everything from one-time payments to complex subscription models and marketplace payments, with built-in fraud prevention tools and PCI compliance for high security standards.

Key Features:

- Advance fraud detection and prevention

- 135+ currencies accepted

- Customizable checkout experience

- API documentation very comprehensive

- In-built subscription management

- Real-time reporting and analytics

Pros:

- Developer documentation was very good.

- It was quite highly customizable

- High volume merchants got very competitive pricing

- Fantastic fraud protection.

Cons:

- Complicated for a non-tech person to get it set up.

- Fees on international transactions are pretty much more expensive than the rest

- Users had complained of stability in the account

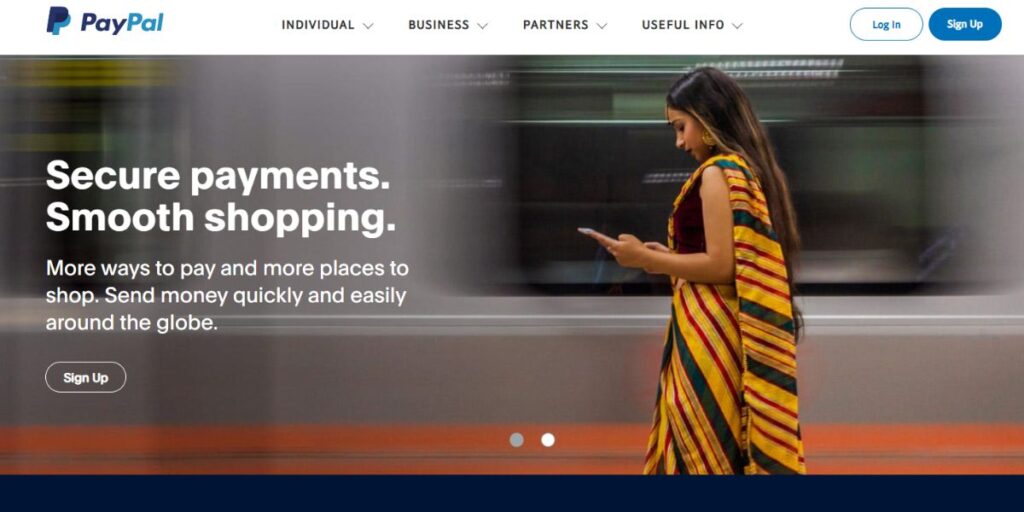

2. PayPal

- Rating: 4.8/5

- Best For: Small and medium-sized enterprise

PayPal has maintained a good portion of the market share in the payment gateway arena with its ease of usage interface and the consumers’ already-built trust. Be it simple buttons or advanced check-out systems, PayPal is perfect for every kind of business.

They offer security and guard against frauds, and they can receive any number of currencies; thus, they have grabbed an immense chunk of popularity from the international markets. The present checkouts improvements along with the integration of mobile payments have improved them even further.

Key Features:

- One click payment

- Protection for the buyer and the seller

- Optimization for the mobile

- Multicurrency payment option

- Transfers are done instantly

- Generating invoice

Pros:

- Extremely well-known and trusted brand

- Easy to set up and use

- Fantastic customer protection

- Mobile-friendly

Cons:

- More transaction fees compared to some other rivals

- Account holds can be regular

- Customer support can be slow

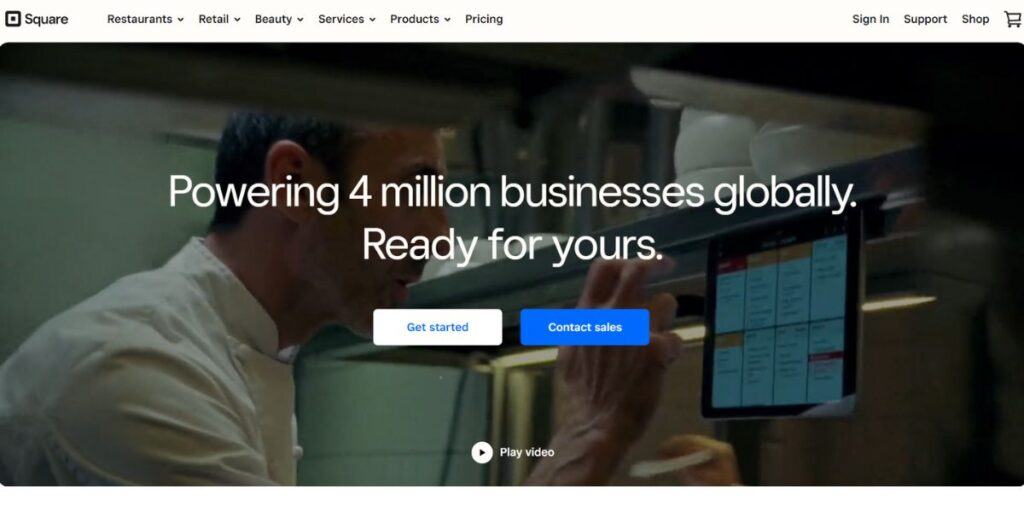

3. Square

- Rating: 4.7/5

- Best For: Small and Retail Business

Square has profoundly changed the payments processing industry simply because of the innovative approach in the processing of both online as well as offline payments. It provides an integrated platform of business applications that include a point-of-sale system, stock management, and analytics. Expanding the online payments range, for individuals dealing with the physical as well as online businesses, Square becomes a single gateway.

However, what makes it particularly appealing for a small business owner looking for an all-around, reliable solution to process their payments is transparent pricing and the extremely user-friendly interface.

Key features:

- POS included and Card reader is free

- Inventory control and Employee control

- Sale analytics

- eStore creator

Pros:

- Price is clear; there is no monthly charge for service.

- Physically and digitally integrating into their storefront.

- Friendly User Interface.

Cons:

- Very minimalistic interface

- Doesn’t let owners add more customizable touches

- Debit or check payments by filling out and delivering are much higher fees.

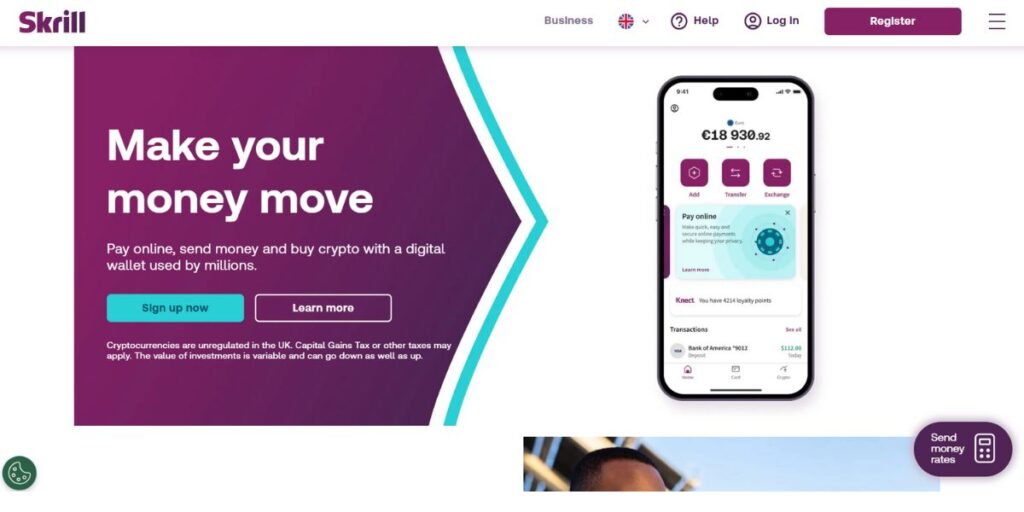

4. Skrill

- Rating: 4.6/5

- Best For: International business and digital entrepreneurship

Skrill has established itself as one of the Best eCommerce Platforms for eCommerce Payment Gateways, particularly for international transactions in Europe and emerging markets. It excels at making fast, secure money transfers and digital wallet services across multiple currencies and countries.

Its recent technological upgrades have made it even more appealing to businesses with a global customer base, thanks to improved transaction processing speeds and security measures. Widely used in gaming and to facilitate forex transactions, Skrill has extended well beyond classical eCommerce usage models. The competitive fees for international transfers and currency exchange further solidify its position as a top choice among eCommerce platforms.

Key features:

- Digital wallet account

- Very fast bank-to-bank deposit

- Coin support

- Multi-currency accounts

- Low fees across international transfers

- Advanced protection

Pros:

- Ideal solution when making international trades

- Extremely competitive currency converter

- Lightning-fast processing rate

- International acceptance is well spread

Cons:

- Pricier startup fees than alternatives

- Low penetration into the US market

- Customer support is unreliable at times.

5. Braintree

- Rating: 4.7/5

- Best For: To customize and size customization to medium or larger-sized businesses

Braintree wholly-owned subsidiary with a focus on customizable, advanced payments. Advanced solutions include simplicity for international payment handling and difficult scenarios. Using its robust API and development toolsets, users are able to craft the highly customized checkout while remaining within all required security provisions.

Braintree is ideal for any company that needs to expand to more international markets because it allows for several forms of payments and currencies. In addition, it has a number of sophisticated features for protecting against fraud as well as subscription-based recurring billing tools.

Key Features:

- Advanced fraud protection

- Recurring billing

- Multiple payment method support

- Data portability

- Extensive API documentation

- Marketplace payments

Pros:

- Great developer tools

- Strong integration with PayPal

- Complete payment solutions

- Robust security

Cons:

- Difficult to set up

- More expensive for small merchants

- Technical skills required

6. Payline

- Rating: 4.5/5

- Best For: Healthcare and high-risk industries

Payline has found its niche as a provider for businesses that operate in industries that are considered high-risk, as well as healthcare sectors. It has specialties in medical billing and healthcare payment processing, including HIPAA compliance features. Transparent pricing and the use of an interchange-plus pricing model make them increasingly attractive to businesses that work with large volumes of transactions.

Excellence in customer service and support is also where Payline differentiates itself in the industry: it offers personalized assistance regarding complex integrations and troubleshooting issues.

Key Features:

- Health care payment solutions

- Interchange-plus pricing

- Virtual terminal

- Mobile payment processing

- Advanced level security measures

- Specific industry solutions

Pros:

- High-risk industry-friendly

- Transparent pricing

- Customer service is very good

- HIPAA compliant

Cons:

- Monthly minimum requirements

- Not represented well globally

- Higher setup fees

7. Authorize.net

- Rating: 4.6/5

- Best For: Established businesses require advanced features.

Authorize.net is a brand that is backed by Visa, one of the oldest known and best eCommerce payment gateway solution providers in the market. Advanced fraud detection and prevention capabilities will minimize chargeback and fraudulent transactions on the businesses. T

he recent improvements on the user interface and reporting have helped improve the reporting ability of the merchants to track and analyze the data from transactions easily. With numerous payment types and currencies along with solid security, this gateway serves as a solution for established companies who want an all-features loaded payment solution.

Key Features:

- Advanced fraud detection

- Recurring billing

- Customer information management

- Detailed reporting tools

- Supports multiple payment type

- Automated account updater

Pros:

- Good security feature

- Reporting

- Great fraud prevention

- Good brand reputation

Cons:

- Monthly fee will be little high

- Complex pricing

- The process of setup will take longer time

8. Google Pay

- Rating: 4.7/5

- Best For: Mobile-first companies and Android users

Google Pay is among the top digital payment solutions, with mobile commerce and contactless payment experiences. They depend on the deep technology capabilities of Google for an easy checkout experience across any device and operating system. Since it is integrated directly into Android phones and Chrome browser, checkouts can be pretty effortless for the users within the Google fold.

It has been widely adopted by mobile commerce-focused merchants since it recently added advanced security features and expanded merchant tools. Google Pay smart tokenization technology allows for safe transactions with rapid processing times.

Key Features:

- One-tap checkout

- Cross-platform compatibility

- Smart tokenization

- Integration with loyalty programs

- Advanced analytics

- Contactless payment support

Pros:

- Fast checkout process

- High security measures

- Great mobile integration

- No extra processing fees

Cons:

- It has fewer customization options

- It requires a Google account

- Not as widely used as some competitors

9. 2Checkout (now Verifone)

- Rating: 4.5/5

- Best For: International businesses seeking global reach

2Checkout is a part of Verifone and specializes in global payment processing with a wide international reach. It offers localised payment methods and currencies to more than 200 countries, thus it is suitable for businesses that seek global expansion.

Their subscription management tools and recurring billing are robust and more than adequate to support digital goods and services providers. Acquisition by Verifone resulted in the perfect fit for the business with so much better resources, infrastructure, and reliability than that. Their help with compliance and regional tax supports international expansion more easily for the merchants to get global.

Key Features:

- Global payment method

- Subscription management

- Tax calculation and handling

- Multiple currency

- Fraud preventions

- High-end invoicing system

Pros:

- Rampant across the globe

- Strong subscription capabilities

- Excellent in tax handling

- Good conversion optimizer

Cons:

- It has higher transactions fees

- Has a complex price structure

- Integration may be difficult.

10. Apple Pay

- Rating: 4.8/5

- Best For: iOS-centric enterprises and high-end retailers

Apple Pay continues to be the leading payment platform in the world of iOS, one that integrates perfectly with Apple hardware and software and services. There is a much stronger focus on security and consumer privacy, making it a lot more appealing and smoother checkout.

It is more so for premium and luxury retailers who appreciate the speed and security it provides through biometric authentication and tokenization. Recent improvements from Apple Pay into its merchant services and advanced analytics have made this product more business-friendly but still maintain the sleek, user-focused experience Apple is all about.

Key Features:

- Biometric authentication

- Express checkout

- Tokenization security

- In-app payment

- Web payment

- Real-time transaction monitoring

Pros:

- Best in UX/UI

- High on security

- Fast checkout process

- High brand credibility

Cons:

- Only supporting the Apple ecosystem

- Implementation costs are relatively high

- Requires an iOS device for easy setup

11. Amazon Pay

- Rating: 4.6/5

- Best For: Online sellers targeting Amazon users

Amazon Pay uses the large customer base of Amazon to provide a trusted payment solution for online sellers. With the integration with Amazon user accounts, checkout experiences are quick and one-click, which can dramatically reduce cart abandonment rates.

Their focus on fraud prevention and buyer protection makes it particularly attractive to both merchants and customers. Innovation of voice commerce is possible for more innovative experience shopping through addition with Alexa voice capabilities. Extra business value provided is robust reporting and merchant protection in Amazon Pay.

Key features:

- One click checkout

- Supporting voice commerce

- Fraud protection

- A/B Testing Tools

- Optimised for Mobile

- Micro analytics

Pros:

- Huge customer base

- Established brand

- Perfect fraud protection

- Easy to integrate into another application, without much ado

Cons:

- Cost a little higher as compared to many of its alternatives

- The features are on a limited spectrum for customization.

- Potential competition concerns

12. Sage Pay (now Opayo)

- Rating: 4.5/5

- Best For: UK and European companies

Sage Pay, also known for trading as Opayo, is the UK and Europe’s leading independent payment gateway. The company delivers a fully enclosed payment solution in a secure environment. Changes due to rebranding and in the platforms for the past several years have also improved the capabilities and integration with the gateway to make it the most competitive product in modern payment solutions.

It knows what European payments regulations are all about, so the gateway also excels at compliance. Therefore, it makes it the most precious to the businesses performing their trades in such markets. Its powerful customer support and merchant services make a difference in this regional market.

Key Features:

- A strong presence in Europe

- Sophisticated fraud screening

- Multi-currency support

- Recurring payment tools

- Reports are highly detailed

- Complies with PCI DSS

Pros:

- Support in the UK/EU is fantastic

- Reporting tools are okay

- The platform is very respectable

- Security features are great

Cons:

- Less global visibility

- More expensive setup charges

- Not a viable option for small business firms

Tips for Selecting the Best eCommerce Payment Gateway

Here are the tips for selecting the best eCommerce Payment Platforms:

- Transaction Fees: Check the fees charged for each transaction, which include processing fees, monthly fees, and other costs.

- Supported Payment Methods: Check if the gateway accepts the payment modes preferred by your target audience (credit cards, debit cards, digital wallets, etc.).

- Security Features: Prioritize gateways that provide strong security features like tokenization, encryption, and fraud prevention.

- Ease of Integration: Ensure the gateway can be easily integrated with your e-commerce platform, such as Shopify, WooCommerce, etc.

- Customer Support: Consider a gateway whose customer support service is topnotch, helping you to get past technical issues quickly.

- Scalability: Select a gateway that can scale to your business model and support larger volumes of transactions.

- International Transactions: If selling internationally, confirm that the gateway supports international transactions and supports numerous currencies.

Conclusion

One major aspect of getting an online business up and thriving well is selecting a suitable ecommerce payment gateways. Businesses can come up with an ideal option with careful consideration toward transaction fees, supported payment options, security elements, and integrations to enable them to opt for the very best to optimize their pay processing and upgrade the customer’s experience.

FAQs

Q1: What is the popular gateway for e-commerce?

Paypal and Stripe top the list amongst the most utilised and prevalent gateways on the planet.

Q2: How do I select the best payment gateway for my business?

Your business size, target audience, transaction volume, budget, and required features

Q3: What are the key security features to look for in a payment gateway?

Tokenization, encryption, fraud prevention tools, and PCI DSS compliance

Q4: What are the common types of eCommerce Payment Gateways?

Common types of payment gateways are: Hosted and integrated payment gateways.