Government-owned financial institutions have been the pillar of the economic development of India over several decades as the banking landscape of the country is dominated by strong banking institutions owned by the government. The list of govt banks in India is a thorough coverage of Public Sector Banks (PSBs) which are important in financial inclusion, rural development and overall economic development.

These government banks have played major roles in implementing several national policies, supporting small business and also making banking services reach every corner of the country. Knowledge of this list of govt bank in India is vital to customers, investors, and any individual interested in the Indian banking industry.

Importance of Public Sector Banks (PSBs) in India

- Financial Inclusion: PSBs have been the exemplars of providing banking services to the un-banked populations particularly in rural and semi-urban regions where the private banks fear venturing due to the unpopularity of profitability.

- Government Policy Implementation: These banks are important vehicles to implement the government schemes such as Jan Dhan Yojana, Mudra loans, and several subsidy programs, and the benefits of the schemes reach the beneficiaries through direct benefit transfer.

- Economic Stability: The stability offered by government banks during economic downturns and market fluctuations is the secure banking service that is supported by the government and is covered by the government-backed deposit insurance.

- Priority Sector Lending: PSBs are required to lend a substantial amount of funds to focus sectors such as agriculture, small scale industries and weaker sections of the society.

- Job Creation: Government banks being some of the biggest employers in the country offer a stable employment opportunity and ensure that the human resource development in the financial sector is taken care of too.

- Social Banking: These banks pay attention to social goals as well as to commercial viability, serving national development goals and facilitating poverty alleviation programs in the nation.

Role in Economic Growth, Financial Inclusion, Rural & Urban Banking

The government banks in India have been the pivotal mechanisms in overall economic growth within both the rural and urban areas. In rural regions, these banks have developed wide networks that offer the much needed financial services to farmers, tiny entrepreneurs, and marginalized groups who are not able to access bank services. They also provide loans to agriculture, crop insurance, and provide seasonal credit facilities which are essential to sustaining the livelihood of the rural population.

In the cities, the government banks facilitate big industrial projects, infrastructure construction and corporate lending besides providing low-cost banking to middle-income households. Their contribution to financial inclusion is quite remarkable since they have been able to open millions of bank accounts under the government programs, which facilitated direct benefit transfers and cashless society among a wide variety of population segments.

What are Government Banks in India?

In India, the government banks, also called Public Sector Banks (PSBs), are those in which the Government of India owns the majority stake, most often over 51%. These banks came up through the Banking Companies (Acquisition and Transfer of Undertakings) Acts of 1970 and 1980 that nationalized large private banks to promote wider national interests. As opposed to private banks that maximize on profitability, government banks are more concerned with balanced growth which entails commercial viability and social responsibility. For anyone exploring the List of Govt Banks in India, these institutions represent stability and inclusiveness in the financial system.

The key difference is that they have different ownership structure, operational goals, and regulation. Although the nature of the business of the two different kinds of banks is the same they are only different in the sense that where the shareholders who are the owners of the private banks operate the bank with the main objective of making profit, PSBs are owned by the government and must therefore, be able to align their operations with national policy objectives so that they have equitable distribution of credit and also be able to support government schemes to the development of the economy as well as the social welfare of the people.

How Many Govt Banks are There in India (2025)?

Current Count of PSBs (After Mergers):

- As of 2025, India boasts of 12 Public Sector Banks in operation in India

- These are the merged banks that were established in the course of the strategic merger activities conducted between 2017-2020

- The 12 banks consist of leading banks such as SBI, PNB, Bank of Baroda and Canara Bank

- Any combination of the entities will pool resources, technology as well as customers in order to achieve better efficiency

Historical Background – More than 25 Earlier, Now Consolidated:

- There were 27 public sector banks in India; the consolidation drive started thereafter

- With the nationalization waves in 1969 and 1980, there were more than 25 government banks established initially

- This number was decreased strategically in order to enhance operational effectiveness and financial stability through mergers

- This merging resulted in more competitive and strong institutions that would serve the growing Indian economy in a better manner

Types of Government Banks in India

- Nationalized Banks: These are 11 banks nationalized in 1969, 1980 and are separate entities with government majority ownership and provide both commercial and development banking services.

- State Bank Group: It was initially a group composed of SBI and its associates that have been merged into one – the State Bank of India that accords as the largest state run bank in the country.

- Regional Rural Banks (RRBs): These are the banks sponsored by the government and specifically aimed to serve rural and semi-urban regions which are also owned collectively by the central government, the state governments and the sponsoring commercial banks.

- Development Financial Institutions: Specialized government banks dealing with long-term financing of infrastructures, industry and development projects, many of which have been incorporated into commercial banks over the years.

- Cooperative Banks: These are not government banks but they enjoy substantial government support and control and cater to particular communities and regions with government support and agreement of policy alignment.

- Small Finance Banks: Certain government encouraged banks that specialize in financial inclusion and cater to the unbanked citizens and small enterprises with the support of the government policy and regulatory facilitation.

Comparison Table: List Government Banks in India (2025)

| Bank Name | Founded | HQ Location | Key Strengths |

| State Bank of India | 1955 | Mumbai | Largest network, global presence, digital leadership |

| Punjab National Bank | 1894 | New Delhi | Heritage, extensive rural network, international offices |

| Bank of Baroda | 1908 | Vadodara | Strong international presence, NRI services |

| Canara Bank | 1906 | Bengaluru | South India dominance, technology adoption |

| Union Bank of India | 1919 | Mumbai | Post-merger strength, balanced portfolio |

| Indian Bank | 1907 | Chennai | Regional expertise, customer-centric approach |

| Bank of India | 1906 | Mumbai | Corporate banking, project financing |

| Central Bank of India | 1911 | Mumbai | Agricultural lending, rural focus |

| UCO Bank | 1943 | Kolkata | Eastern India presence, community banking |

| Bank of Maharashtra | 1935 | Pune | Regional strength, agricultural expertise |

| Punjab & Sind Bank | 1908 | New Delhi | Small business focus, Northern India presence |

| Indian Overseas Bank | 1937 | Chennai | International banking, trade finance |

List of Government Banks in India (2025)

1. State Bank of India (SBI) – Largest PSU Bank

- CEO: Challa Sreenivasulu Setty is the incumbent chairman of the State Bank of India as of 28 August 2024

- Branches: More than 22,000 branches all over the country

- Headquarter: Mumbai, Maharashtra

- Year Established: 1955 (as SBI), origin dates to 1806

SBI is currently the biggest commercial bank in India with 23% market share of assets and a 25% market share of total loans and deposits. The bank has a wide network of customers that span more than 500 million customers on a domestic and international level. SBI is a pioneer in the digital banking innovation, government schemes and international presence covering 36 countries. As a leading name in the list of govt banks in India, its total package of services includes retailing, corporate, international banking and treasury operations, and is thus a one stop financial solution provider.

2. Punjab National Bank (PNB)

- CEO: Shri Ashok Chandra became Managing Director & Chief Executive Officer of the Punjab National Bank on 16th January 2025

- Branches: There are around 12000 branches

- Headquarters: New Delhi

- Year Established: 1894

PNB is the second largest government bank with a rich history of over 130 years. The bank has very strong retail banking, agricultural, and MSME lending. PNB has a global presence with offices around the world especially in the financial centers. The bank has a reputation of strong technology base, focus on the customer and the wide spread of its branches in the rural areas. As an important part of the list of govt banks in India, it has a major part in the implementation of government schemes and has close ties with corporate clients as well as millions of individual customers.

3. Bank of Baroda (BoB)

- CEO: Debadatta Chand

- Branches: More than 9,500 branches

- Headquarters: Vadodara, Gujarat

- Year Established: 1908

Bank of Baroda has a reputation of being strong internationally with more than 100 overseas offices in 17 countries. The bank is especially strong in offering services to the Indian diaspora and providing international trade finance. BoB has done very well in agribusiness loans, rural banking, and financing small and medium enterprises. The bank has adopted digital transformation massively and has provided new digital banking services. Featured prominently in the list of govt banks in India, it has a wide product range offered that includes retail banking, corporate banking, international banking, and the services to NRI customers all over the world.

4. Canara Bank

- CEO: K. Satyanarayana Raju

- Branches: nearly 10,000 branches

- Headquarters: Bengaluru, India

- Year Established: 1906

Canara Bank is an Indian bank that has a long history and good reputation because it has a dense coverage of South India and provides customers with high-quality services. The bank pays much attention to technology implementation and online banking services. Canara Bank has been a market leader in retail banking, agricultural lending and small business lending. Featured in the list of govt banks in India, it is an increasingly international operation with a powerful corporate banking operation. The bank has also been associated with innovation, effective customer service delivery and financial inclusion schemes in both the rural and urban markets.

5. Union Bank of India

- CEO: A. Manimekhalai

- Branches: There are around 9500 branches

- Headquarter: Mumbai, Maharashtra

- Year Established: 1919

The Union Bank of India has become a competent player recently through merger of strengths of many institutions. The bank maintains an equilibrium balance in terms of retail, corporate and agricultural banking. Union Bank is also characterized by its good risk management policies and the rising asset quality. The bank is preoccupied with the digital transformation and customer experience improvement. It is highly knowledgeable in project financing, working capital financing, and government drive in economic development activities whilst maintaining a healthy presence in all segments of the banking industry. Featured in the list of govt banks in India, Union Bank continues to strengthen its role across diverse financial sectors.

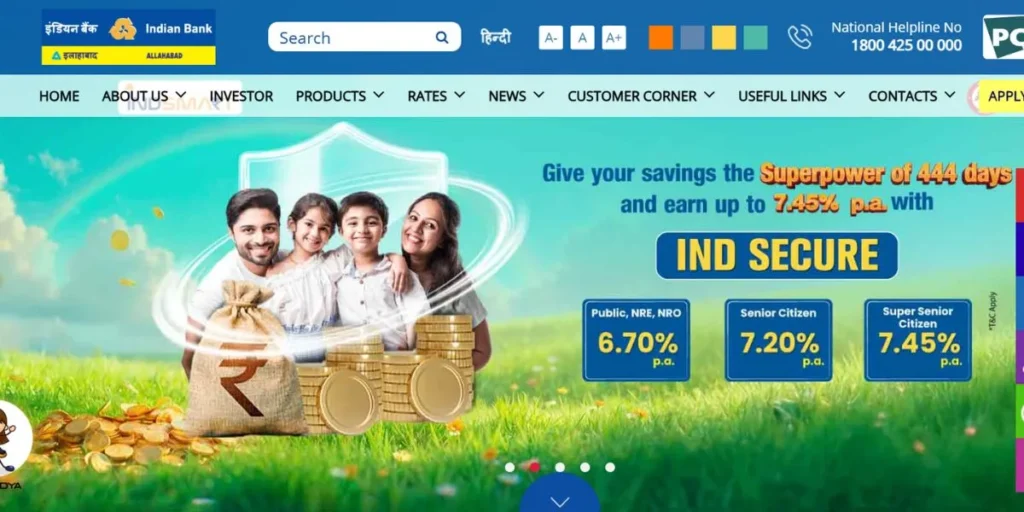

6. Indian Bank

- CEO: Shanti Lal Jain

- Branches: More than 6,000 branches

- Headquarters: Chennai, Tamil Nadu

- Year Established: 1907

Indian Bank has a regional presence especially in South India, and it is customer-centric with innovative banking products. The bank has managed to incorporate the advanced technology in the traditional banking values. Indian Bank has an outstanding performance in agricultural financing, MSME financing and retail banking services. It is also building an online banking business and has good corporate banking operations. The bank is acknowledged to have operation efficiency, good financial management, and dedication to serve various classes of customers including individual account holders and large companies. Being part of the list of govt banks in India, Indian Bank continues to expand its reach while staying true to its customer-first approach.

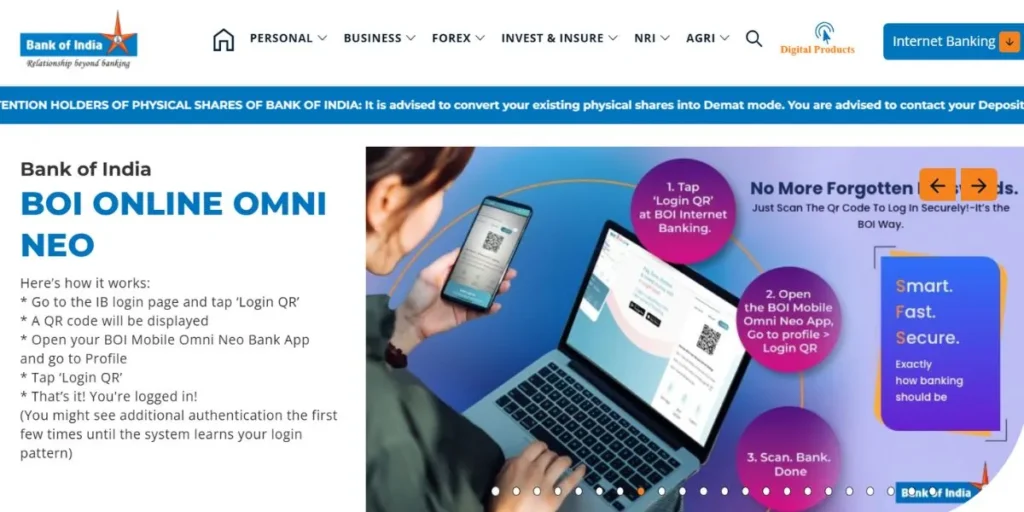

7. Bank of India (BoI)

- CEO: Rajneesh Karnatak

- Branches: About 5,100 branches

- Headquarters: Mumbai, Maharashtra

- Year Established: 1906

Bank of India is one of the first generation of public sector banks having a long history of service in the Indian banking arena. The bank is well established in Western and Central India and has good banking services. BoI has extensive experience in corporate banking, project funding and cross border banking activities. The bank has been concentrating on digital transformation and enhanced efficiency in its operations. It has close ties with the government and corporate bodies as well as offering all-inclusive retail banking facilities to the countrywide millions of customers.

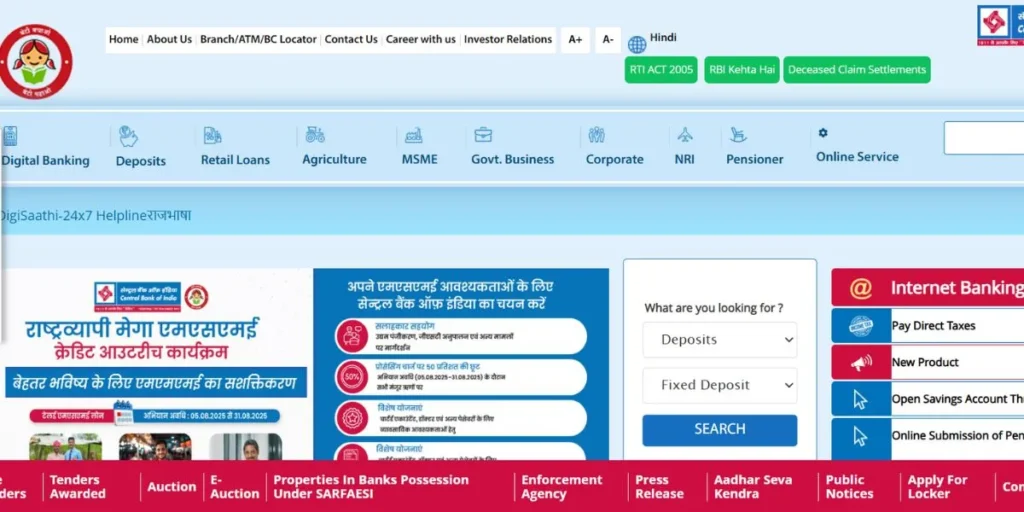

8. Central Bank of India

- CEO: M.V. Rao

- Branches: Roughly 4,800 Branches

- Headquarters: Mumbai, Maharashtra

- Year Established: 1911

The Central Bank of India is well established in India and especially in Central and Western regions. The bank has a reputation of dealing with the agricultural loaning and the services to the rural banks. The Central Bank has been on the forefront in the government schemes and financial inclusion programs. The bank provides the full range of banking services in retail, corporate and international banking. It has also been making massive investments in technology upgrade and digital banking facilities to drive customer experience and operational efficiency without compromising its focus on serving rural and semi-urban markets.

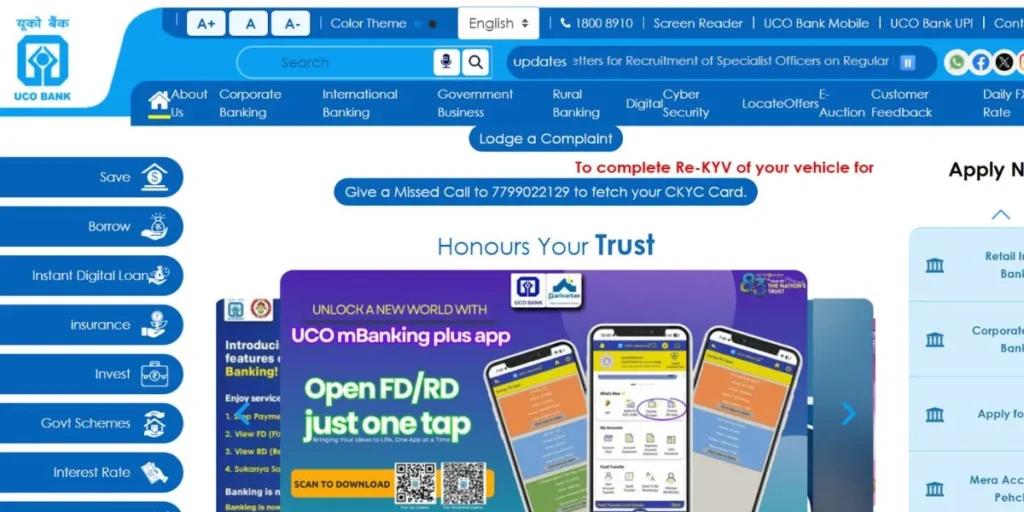

9. UCO Bank

- CEO: Soma Sankara Prasad

- Branches: more than 3,000 branches

- Headquarters: Kolkata, West Bengal

- Year Established: 1943

UCO Bank is a well-established bank in Eastern India and is famous because of its customer-centric policies and community banking. The bank is experienced in small and medium enterprise financing and lending to the agriculture sector. As one of the oldest Government Banks in India, UCO Bank has been spending on technology and digital banking platforms in order to enhance service delivery. The bank enjoys good relations with the local businesses and communities, as well as developing presence in other regions. It has a full range of banking services and products, with specialization in retail banking and government scheme implementation in rural development.

10. Bank of Maharashtra

- CEO: Nidhu Saxena

- Branches: 1,900 branches

- Headquarter: Pune Maharashtra

- Year Established: 1935

Bank of Maharashtra is a strong bank with deep roots in Maharashtra and with increasing presence in India. The bank prides itself on personalized customer care and good relationship with the community. It also has a specialization in agricultural lending, lending to MSMEs and retail banking. As one of the leading Government Banks in India, Bank of Maharashtra has been engaged in the process of digitalization and making its operations more efficient. The bank has been able to maintain good relations with the business entities and the agricultural communities of the country as well as diversify the products and services offered in the bank to compete favorably in the contemporary banking environment.

11. Punjab & Sind Bank

- CEO: Swarup Kumar Saha

- Branches: There are about 1,500 branches

- Headquarters: New Delhi

- Year Established: 1908

Punjab and Sind Bank has a very strong base in Northern India and is recognized as a provider of loans to the small businesses and agricultural loans. This bank has been meeting the changing market conditions by the adoption of technology and improvement in services. It enjoys good ties with the local communities and businesses and at the same time it has increased its coverage. As one of the Government Banks in India, Punjab & Sind Bank is a complete banking institution with a specialisation in retail banking and financing of small business establishments. The bank has been undertaking efforts to enhance its financial performance and operational efficiency, and at the same time fulfilling its obligation to serve various customer segments.

12. Indian Overseas Bank

- CEO: Partha Pratim Sengupta

- Branches: Approximately 3,400 branches

- Headquarters: Chennai, Tamil Nadu

- Year Established: 1937

Indian Overseas Bank is a formidable presence in South India and as the name suggests it has a lot of international banking capabilities and NRI services. The bank has experience in terms of trade finance, foreign exchange, and overseas banking services. OB has been concentrating on enhancing its asset quality and operational performance by means of enhancing risk management and adoption of technology. The bank, being one of the prominent Government Banks in India, has a wide range of banking services with a special focus on corporate banking and international activities. It has good ties to the corporate customers and individual consumers and is engaged in the process of digital transformation.

Which Govt Bank is Best in India?

Choosing the leading government bank is a personal choice of banking needs and service preferences in terms of the various banking segments and customer categories.

- State Bank of India (SBI) -Largest Network, Global Presence SBI has the largest network and an international presence in the country. It has 22,000+ branches all over India and is also present in 36 countries around the world serving 500+ million customers with all-inclusive digital banking services.

- Bank of Baroda -Overseas Presence BoB has a strong international presence with 17 countries, 100+ locations overseas. It is perfect with NRI customers, international trade finance, and global banking services and expertise with respect to foreign exchange.

- PNB, Canara, Union Bank – Good Retail and Corporate Banking Solutions The banks have good retail as well as corporate banking services. NB has 130-year-old banking history and vast rural coverage. Canara Bank has a good presence in the south of India offering good customer service. The post-merger consolidation will bring about balanced portfolio strength to Union Bank.

Recent Mergers & Consolidation of Government Banks

- Strategy of the Anchor Bank: 6 independent public sector banks – SBI, Bank of Baroda, Punjab National Bank, Canara Bank, Union Bank of India and Indian Bank, became anchor institutions to take over smaller banks and form stronger banks.

- Operational Efficiency: The process of the merger was meant to cut down on duplication of operations, minimize the administrative expenses, streamline the branch networks, and maximize the use of the technology platforms across the unified organizations.

- Increased Capital Base: Merged banks were able to have a stronger capital ratio, better asset quality and financial stability to enable competition with private sector banks and fulfill the Basel III regulations efficiently.

- Geographic Expansion: Consolidation helps banks extend their geographic presence, reach new markets and markets and provide better service to customers via a united network of branch offices and service capacities across geographical areas.

- Technology Integration: Merged entities enjoyed the benefit of better technology infrastructure, common digital platforms and increased IT capabilities that resulted in better customer service and operational efficiency across the various channels of banking.

- Fewer Banks: Consolidation achieved the goal of a reduced number of public sector banks, 27 in 2017 and 12 in 2025, to produce powerful and competitive institutions able to serve the growing Indian economy.

Conclusion

The list of government banks in India shows a very impressive financial ecosystem that continues to be the backbone of financial inclusion and economic growth in India. These 12 consolidated government banks which have their mainstays in State Bank of India, Punjab National Bank and Bank of Baroda etc have readily adapted to the challenges of modern banking practice without compromising their social banking agenda.

The recent merging has created more effective and strong institutions that can compete even with the global market and still render their services to the rural and underbanked population. These government banks are investing heavily in technology and innovation as India is moving towards a digital economy without abandoning their focus on inclusive growth. It is necessary to know this comprehensive list of govt banks in India to make better choices concerning banking and realize its significant role in building the nation.

Frequently Asked Questions (FAQs)

What are the number of government banks in India in 2025?

In India, there will be 12 public sector banks in 2025, down from 27 because of strategic mergers and consolidations.

What is the largest government bank in India?

SBI is the largest government bank that has more than 22,000 branches and 500+ million customers around the globe.

What is the distinction between the public and the private banks?

Public sector banks are owned by the government (51%+) whereas the private banks are owned by individuals and also by other private groups.

Are bank deposits with government agencies safe?

Yes, the deposits of up to 5 lakh per depositor are guaranteed by the Deposit Insurance and Credit Guarantee Corporation (DICGC).

What is the best government bank to have international banking?

Bank of Baroda is regarded as the best in international banking given its presence in 17 countries and full service NRI services.