Under current business speed requirements maintaining efficient invoicing methods serves two purposes: cash flow management and uninterrupted payment streams. The correct selection of software for invoice generation improves workflow efficiency while simultaneously decreasing errors and saving time in billing operations. Your business faces complex choices in selecting the ideal invoice software from among multiple available options.

This article will provide you with an analysis of leading market invoice software solution’s present features alongside business-appropriate benefits and functional characteristics. Your choice of invoicing tool depends on your business model no matter if you work as a freelancer or manage a small business or a more extensive organization since proper invoicing software simplifies financial operations while boosting efficiency.

Top Features to Look for in Invoice Software

Your selection of invoice software requires consideration of several key features that support your business processes. Here are the most important features:

1. Customizable Templates: The software enables you to create personalized invoices that contain your business aspects such as company logos along with colors and payment terms.

2. Recurring Billing: Invoicing capabilities with guided invoicing allow for the automated creation of client documents for subscription-based engagements as well as for long-term business relationships by reducing routine work.

3. Multi-Currency and Multi-Language: This invoice solution can deliver solutions to international corporate clients through flexible options for currency choice and language.

4. Integration with Accounting Tools: This business integration allows its financial software into the accounting tools, including QuickBooks or Xero, automating data syncing that eliminates manual entries.

5. Payment Gateway: This invoice service allows physical as well as online payment gateways such as PayPal and Stripe, for direct online payments from the invoice itself.

6. Tax Calculation: Permission granting systems use business-specific location data that help in complying with regulations to calculate taxes.

7. Expense Tracking: Expense tracking capabilities support financial control and enable profitability reporting.

8. Payment Reminders: Things are easy when automatic invoice payment reminders track overdue payments because they help businesses get paid on time and maintain control of their receivable balance.

9. Mobile Access: Users now access invoice management systems through mobile applications and the cloud for complete invoice and payment monitoring capabilities anywhere.

10. Reporting and Analytics: Financial reporting informs business individuals about payments, outstanding invoices, and financial activities which assists cash flow monitoring and keeps financial operations organized.

The system features improve invoicing operations while maintaining accurate financial records to benefit organizations from small to large sizes.

List of 15 Best Invoice Software

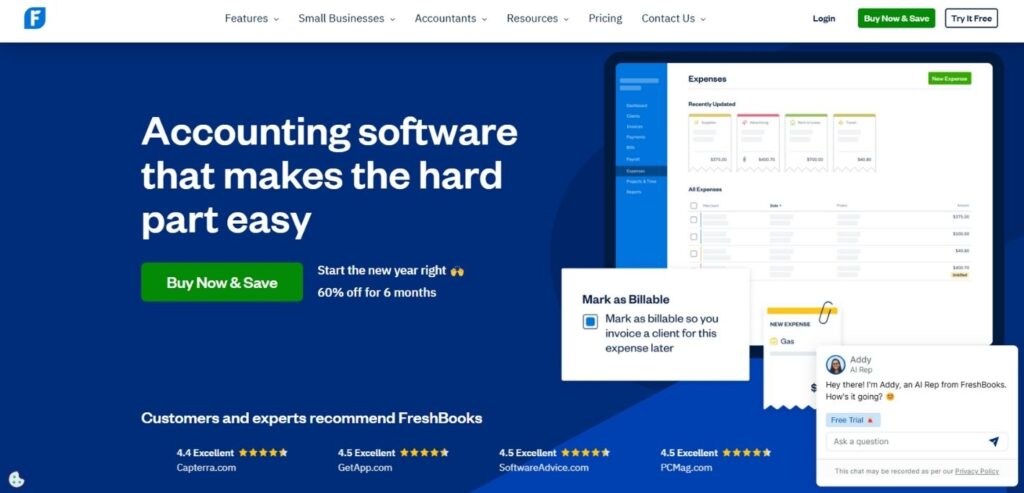

1. FreshBooks

The cloud-certain FreshBooks enables simple to use and targets business accounting to freelancers along with service sector operators and small professional groups. The software package includes flexible invoice generation alongside time tracking functionality together with expense management capabilities combined with automatic billing automation. By using FreshBooks customers receive the ability to create professional invoices while tracking hours and managing their projects with simplicity.

Through payment gateway integrations FreshBooks offers clients a smooth online payment process. The reporting system of this software generates detailed financial reports about business activity while tracking cash flow movements. Reap the benefits of FreshBooks to simplify your financial processes, maintain efficiency, and concentrate on business growth by using its simple design alongside expert support.

Features:

- Cloud-based invoicing and time tracking

- Client management tools

- Expense tracking and reporting

- Recurring billing and subscription management

Pros:

- Easy-to-use interface, ideal for small businesses and freelancers

- Automated features like recurring invoices and payment reminders

- Integrated time tracking for project-based billing

Cons:

- Can become expensive for growing businesses

- Lacks robust payroll features in some regions

- Limited integrations with third-party apps

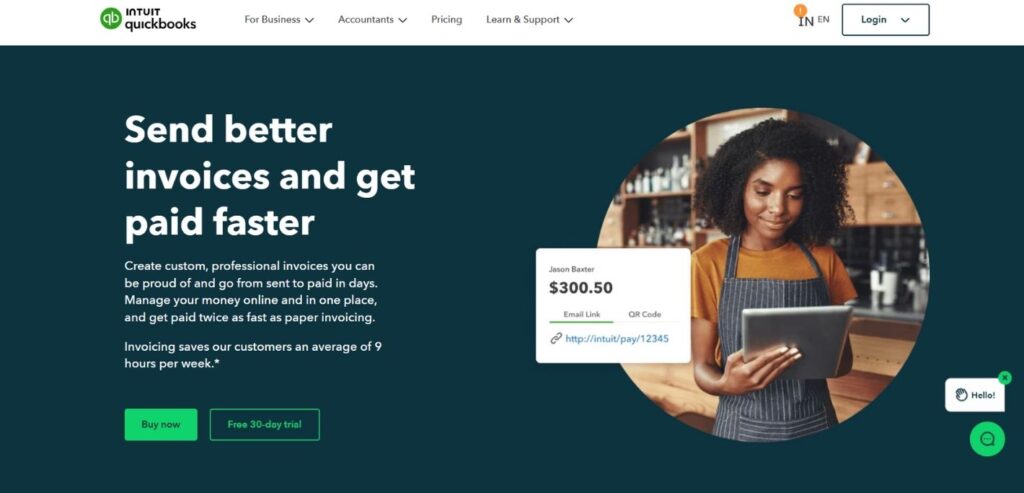

2. QuickBooks

The accounting software QuickBooks delivers advanced financial solutions to businesses in the small to medium size range. Small to medium-sized businesses benefit from QuickBooks’ diverse suite of features which encompasses invoicing operations expense tracking payroll administration tax computation and financial reporting tools. With QuickBooks users will find financial management simplicity together with automated operations and precise tax record-keeping capabilities.

The software combines beginner-friendly integration with cloud computing platforms and supports diverse currencies. QuickBooks delivers its popular status as market-leading accounting software through its smooth interface which streamlines financial operations and decreases bookkeeping mistakes. Users get two access choices: desktop options and online access for their convenience.

Features:

- Invoicing and payment tracking

- Expense tracking and financial reporting

- Payroll processing (with add-on)

- Tax calculations and filing

Pros:

- Highly trusted, scalable for small to large businesses

- Includes comprehensive accounting and tax features

- Integrates well with other financial tools

Cons:

- Complex interface can be overwhelming for new users

- The pricing can be high, especially for advanced features

- Some features only available in higher-tier plans

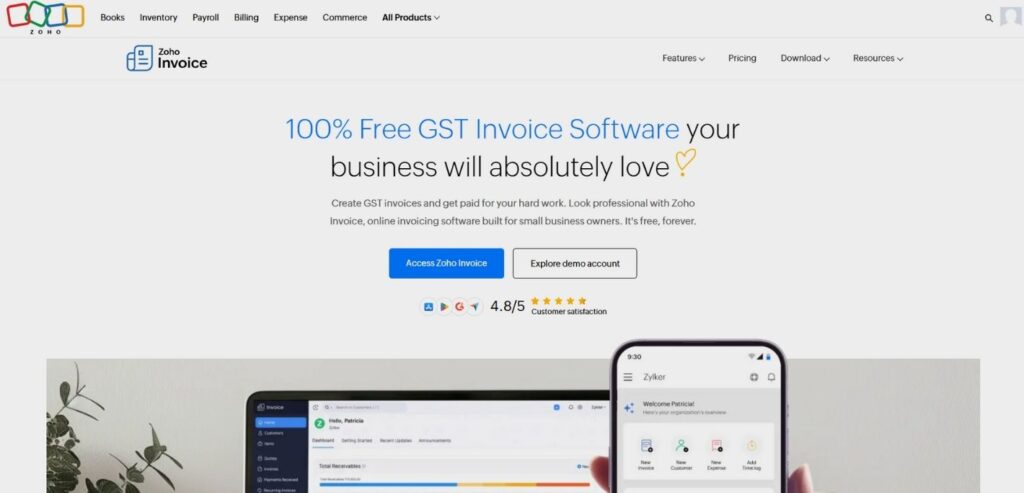

3. Zoho Invoice

The cloud-based platform Zoho Invoice provides small enterprises with an easy-to-use solution to generate sophisticated invoices. This software provides configuration tools for invoice templates along with support for multiple currencies expense management and automated billing reminder functions. Through Zoho Invoice users can monitor their time utilization to automatically generate billing statements that specifically benefit businesses that provide services.

Zoho Invoice offers detailed financial reports to help businesses monitor their business performance while staying on top of their finances. Through its built-in integrations with PayPal and Stripe payment gateways, Zoho Invoice simplifies the process of receiving payments quickly. Companies are just starting to have access to a cost-free plan through Zoho Invoice software.

Features:

- Customizable invoice templates

- Time tracking and project management tools

- Automated payment reminders

- Integration with other Zoho apps and third-party tools

Pros:

- Free plan available for small businesses

- Highly customizable invoicing options

- Strong reporting features

Cons:

- Limited integrations compared to other tools

- No payroll or advanced accounting features

- Learning curve for some advanced features

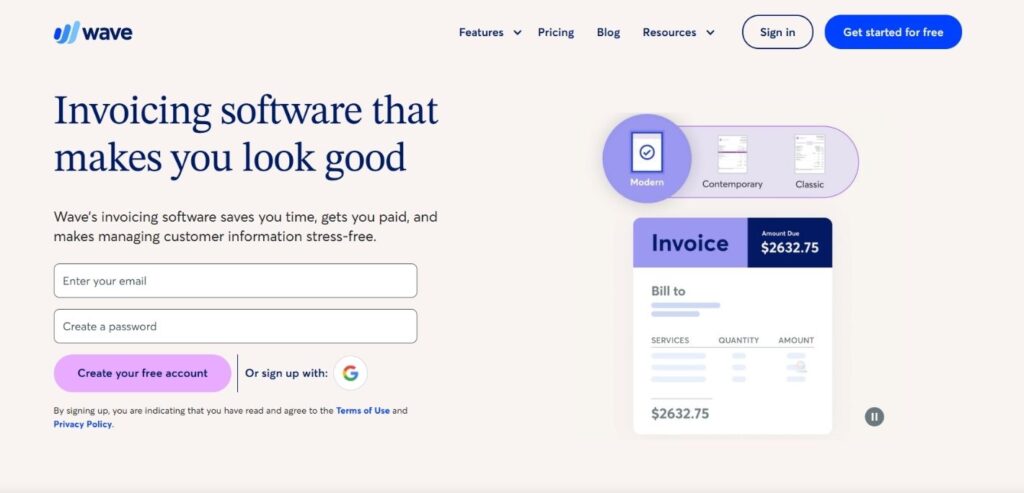

4. Wave

The cloud-based accounting solution Wave provides free services for small businesses alongside freelancers. The software allows users to build custom invoices and track expenditures while adding scanning features for receipts and providing reporting capabilities for finances. Through Wave, users can simplify business financial management because it provides tools for monitoring profits alongside expenses and revenue tracking.

The solution presents a basic and accessible user interface that allows anyone regardless of accounting experience to easily find their way through the system. Users can access Wave’s free services and beyond these options, they have the opportunity to purchase payment processing with add-ons and payroll service options. Due to its cost-efficient characteristics, Wave presents itself as an optimal finance and invoicing management solution for businesses.

Features:

- Free invoicing and accounting tools

- Payment processing with a small fee

- Financial reporting and analytics

- Receipt scanning and expense tracking

Pros:

- Free for most core features

- Easy-to-use and suitable for small businesses

- Good basic accounting and invoicing functionalities

Cons:

- Limited features compared to paid solutions

- Fees for payment processing can add up

- No mobile app for some key features

5. Xero

The cloud-based accounting system Xero delivers financial applications to small to medium enterprises which include invoicing functions as well as payroll management and bank reconciliation services and reporting capabilities. Xero presents an elegant interface that enables businesses to monitor finance activities and maintain budget oversight alongside reliable financial document generation.

The Xero platform enables multi-currency transactions which allow businesses to maintain operations across international borders. Real-time collaboration features in this system enable multiple users to simultaneously access secure management of financial data. Through its third-party application integrations, the software provides businesses with increased versatility. Xero’s flexible pricing structure accommodates businesses of different sizes so growing organizations find it an adaptable financial management solution.

Features:

- Cloud-based accounting and invoicing

- Multi-currency invoicing

- Inventory management and purchase orders

- Bank reconciliation and financial reporting

Pros:

- Strong accounting capabilities and integrations

- Intuitive user interface

- Excellent customer support

Cons:

- Expensive pricing for advanced plans

- Lacks some project management tools

- No direct support for payroll in some regions

6. Invoicely

Businesses can use the online invoicing tool Invoicely to produce professional invoices at a rapid pace. This software system gives users access to flexible invoice templates alongside multiple currency options along with billing cycles, time loggers, and cost management features. Businesses with one to many freelancers can use Invoicely to automate invoice processes and follow their payments.

Through integrations with PayPal and Stripe payment gateways, the software enables users to collect payments directly from their invoices. Users of Invoicely can choose from free and paid plans while premium features for advanced reporting and extra connection options only appear in the advanced versions.

Features:

- Create and send invoices in multiple languages and currencies

- Time tracking and expense management

- Recurring billing and automatic payments

- Customizable templates

Pros:

- Free version available with essential features

- Easy-to-use interface

- Support for multiple currencies and languages

Cons:

- Limited integrations with other software

- Customer support could be improved

- Some advanced features are locked behind paid plans

7. PayPal Invoicing

Businesses along with freelancers can ready professional invoices by using PayPal Invoicing which functions directly from PayPal while maintaining ease of use for all users. The tool provides a free payment solution because users can design invoices, set payment conditions, and brand their financial documents without subscription costs.

Using PayPal Invoicing you can create invoices in multiple currencies so your business can invoice clients across different countries. The system lets clients make instant PayPal transactions as an easy way to complete payments in one streamlined step. Training status tracking is available to users alongside payment reminder functions and financial document organization tools. Clients have access to basic features without charge but PayPal charges transaction fees when they make payments at PayPal.

Features:

- Instant invoicing with PayPal integration

- Customizable templates

- Recurring billing options

- Payment tracking and reporting

Pros:

- No monthly fee, pay-as-you-go model

- Easy integration with PayPal payments

- Instant payments once invoices are paid

Cons:

- Limited reporting tools

- Higher transaction fees for international payments

- Lacks advanced accounting features

8. Bill.com

Businesses in the small to medium-sized category can use Bill.com as their cloud platform for automating accounts payable and accounts receivable operations. Bill.com makes finance operations smoother by using automated methods while working together seamlessly with accounting tools such as QuickBooks and Xero.

Bill.com helps businesses handle bills through approval processes and payments invoice distribution and transaction reconciliation through a fast and secure platform. The system processes payments via ACH while accepting card payments and virtual cards to streamline financial revenue cycles. Bill.com delivers efficient payment management capabilities through its automated system which enables simple use while decreasing errors while maximizing operational productivity.

Features:

- Automated accounts payable and receivable

- Invoice approval workflows

- Integrations with QuickBooks, Xero, and others

- Digital payments and bank account syncing

Pros:

- Simplifies managing accounts payable and receivable

- Integrates with accounting software

- Easy to use with an intuitive interface

Cons:

- Pricing may be high for small businesses

- Limited customization options

- Slow support response times

9. Square Invoices

The free invoicing solution Square Invoices serves businesses to generate professional bills through a rapid process. Through Square Invoices users can customize their invoices and send them via different channels while tracking financial transactions alongside automated overdue invoice notification systems.

The Square Invoices solution links to Square’s payment processing capabilities so businesses can process payments through credit cards along with debit cards and digital wallets. Processing recurring subscription invoices combined with detailed reporting capabilities form essential tools in Square Invoices. The fee-free platform of Square Invoices provides an intuitive mechanism that serves entrepreneurs across freelancing and small business sectors.

Features:

- Customizable invoices with payment links

- Instant payment processing

- Recurring invoices and subscription management

- Mobile app for invoicing on-the-go

Pros:

- Free for basic features

- Fast payment processing with Square

- User-friendly interface

Cons:

- Charges fees for credit card payments

- Lacks advanced reporting tools

- Limited invoicing customization options

10. Sleek Bill

The invoice creation software Sleek Bill delivers clear usability along with speed and efficiency for small businesses and freelancers to generate professional invoices. Users can achieve branded invoicing documents through Sleek Bill’s assortment of customizable templates. Multiple currency support as well as VAT-compliant invoicing and automatic invoice number generation are among Sleek Bill’s features.

Through its suite of tools, this software enables users to track expenses manage inventories and generate reports that monitor financial information. Through its desktop and mobile versions Sleek Bill provides users with convenient invoice management from any location. Sleek Bill functions as a budget-friendly billing solution intended for companies that value simple invoicing functionality.

Features:

- Easy-to-use interface for creating invoices

- Inventory management

- VAT-compliant invoicing

- Automatic invoice numbering

Pros:

- Very affordable pricing plans

- Fast invoicing and batch processing

- VAT support for international invoicing

Cons:

- Lacks some integration options

- Limited to just invoicing features (no full accounting)

- No mobile app for invoicing

11. And.co

The all-in-one business management platform And.co provides its services to freelancers and small businesses. Through its platform users gain access to tools that help with invoicing time tracking and project management alongside expense tracking capabilities. And.co enables users to make variable invoices while setting up recurring payment functions and delivering automated payment alert systems. Users can easily create agreements through And.co’s e-signature feature along with its collection of pre-made templates.

And.co enables users to record their billable hours in addition to managing their tasks according to effective time-use strategies. The platform connects with two payment gateway systems including PayPal and Stripe for simple payment processing. What makes And.co an attractive choice for freelancers is its beginner-friendly design and cost-effective plans.

Features:

- Invoicing and payment management

- Time tracking and expense management

- Contract templates and e-signatures

- Project management tools

Pros:

- All-in-one platform for freelancers and small businesses

- Great for time-based billing and project management

- Easy-to-use interface

Cons:

- Limited accounting features compared to other tools

- Advanced features require higher-tier plans

- No native integration with PayPal

12. Harvest

Harvest serves as software that helps businesses and freelancers conduct time tracking and invoicing while effectively managing their projects and documenting their billable hours. Harvest provides users with three essential functionalities which include tailor-made invoicing tools together with expense record capabilities and integration with leading accounting software including Xero and QuickBooks.

Through Harvest, users can watch their project development while they record their working hours and create detailed reports about their projects. With recurring billing features and automatic payment processing options in the software, users have an easy way to get paid. Harvest serves teams effectively with its interface and mobile app that promotes usability as well as ensures precise invoicing including financial tracking.

Features:

- Time tracking and project management

- Customizable invoices with branding

- Expense tracking and reporting

- Integration with accounting software

Pros:

- Excellent time tracking and project management features

- Easy integration with tools like QuickBooks and Xero

- Good reporting and analytics features

Cons:

- Expensive for smaller teams

- No inventory management or sales features

- Limited payment processing options

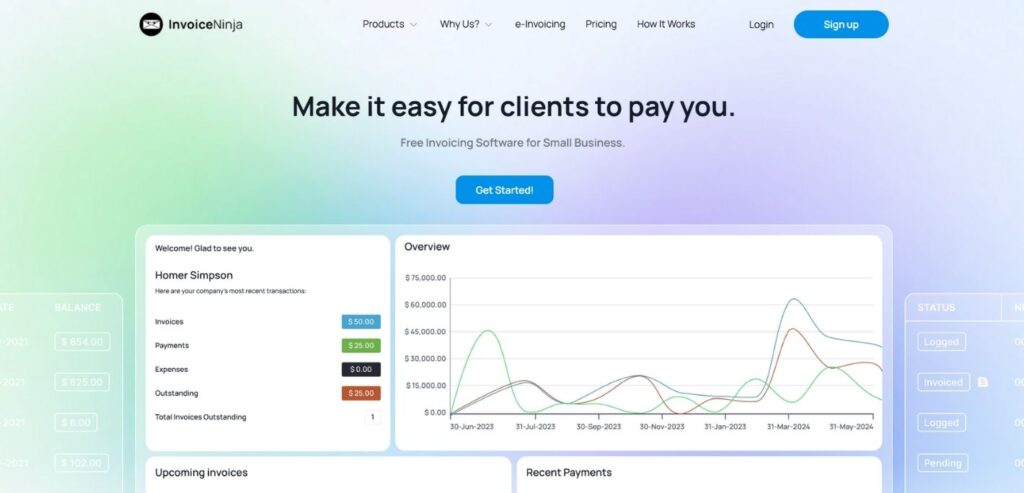

13. Invoice Ninja

Invoice Ninja functions as an open-source invoicing program that equips businesses with functionalities to build professional bills, monitor payment activities, and keep track of expenditures. The platform delivers integrated payment gateway capabilities through support for PayPal and Stripe together with features like certified invoice templates and automated billing and timesheet management. The capabilities of Invoice Ninja for managing different currencies together with various language functions make the solution ideal for enterprises that work globally.

Businesses using its software can access comprehensive performance metrics that help them evaluate their financial metrics. Customers can access free plans from Invoice Ninja and choose paid bundles that provide premium benefits that combine in-depth reporting functionalities with initiative management capabilities along with teamwork platforms. For freelance professionals and small businesses, Invoice Ninja provides a budget-friendly and adaptable invoicing platform.

Features:

- Create unlimited invoices and quotes

- Recurring billing and subscription management

- Payment gateway integrations (PayPal, Stripe, etc.)

- Project management tools

Pros:

- Free plan with core features available

- Highly customizable invoicing

- Supports multiple languages and currencies

Cons:

- Premium version is required for advanced features

- Interface can be overwhelming for beginners

- Customer support can be slow

14. Brevo (ex Sendinblue)

Businesses can easily create and manage their invoices through SendinBlue Invoices which functions as a platform feature. The system enables users to create branded invoices with multiple currency options under one simple interface. SendinBlue applies automatic billing functionality to provide invoices with payment reminders to clients and simplifies payment processing.

Through SendinBlue’s marketing features businesses can integrate invoicing functionality to their email campaigns and maintain operational coherence. SendinBlue Invoices provides an intuitive platform accessible to users who don’t have accounting skills which serves businesses with small to medium-size operations. Through its partnership with Stripe, users can access quick and secure payment options from their accounts.

Features:

- Customizable invoices with branding

- Automated payment reminders

- Multiple currency support

- Integration with email marketing campaigns

Pros:

- Good for businesses already using SendinBlue for marketing

- Affordable pricing

- Easy-to-use with strong automation features

Cons:

- Lacks some advanced accounting tools

- Limited reporting features

- No mobile app for invoicing

15. Kashoo

Kashoo provides a basic cloud-based accounting solution built for business startups and freelance operators. The software allows businesses to generate invoices while tracking expenses and performs automatic bank account comparisons with corresponding financial report generation. Users of Kashoo can produce expert invoices by selecting from customizable templates alongside payment gateway integration for straightforward payments.

The software tracks financial data automatically by connecting to users’ bank records alongside their credit card information. Through its easy-to-read reports, Kashoo delivers real-time financial data that enables businesses to make better decisions. Kashoo provides an intuitive platform and cost-effective pricing suitable for entrepreneurial businesses requiring powerful financial management capabilities.

Features:

- Cloud-based invoicing and accounting

- Bank reconciliation and financial reporting

- Simple expense tracking

- Integration with major payment gateways

Pros:

- User-friendly interface

- Provides solid accounting features for small businesses

- Great customer support

Cons:

- Lacks advanced project management tools

- Limited integrations with third-party apps

- Basic invoicing compared to more specialized tools

Role of Invoice Software in Improving Client Relationships

Every business benefits from invoice software because this software enhances client relationships through streamlined billing operations along with improved communication channels for payments. Here’s how:

1. Professional Invoices: Customer satisfaction and professional branding increase through invoice software which enables businesses to generate polished statements with smooth organization and appropriate company representation. The ability to maintain trust with clients through this approach helps establish high professionalism which produces greater client satisfaction.

2. Automated Payment Reminders: Client payment reminders get issued automatically by invoice software systems which lowers the requirement for manual customer contact. The system reminds clients about payments on time so both parties reduce misunderstandings and achieve timely payments.

3. Transparent Payment Tracking: Real-time invoice status tracking from software solutions lets businesses keep track of invoices across payment stages from paid to pending to overdue. Software-produced payment tracking cuts down both manual errors and helps users avoid ignoring essential payments.

4. Flexible Payment Options: Client payments go through directly from their invoice screens because many invoice system providers connect their platforms to payment gateways such as PayPal and Stripe. The convenience of this payment method leads clients to provide faster payment and enjoy an enhanced service experience.

5. Clear Reporting: The software application produces detailed assessment reports about payment transactions that show current debts along with financial operating metrics so companies can examine their cash flow standings. The transparent interface installed on payment tracking systems helps companies protect their financial stability while building clear financial communication with their clients about bills.

Automated invoice management together with payment tracking functions allows organizations to improve staff efficiency while simultaneously improving client experience and customer relationships and maintaining financial stability.

Conclusion

To sum up, a quality invoice software selection remains vital because it assists organizations in optimizing billing operations enhancing financial cash management, and minimizing accounting errors. The right software toolkit should include customizable templates together with recurring billing functionality and smooth payment integration systems for invoice automation. Growth-ready businesses require invoice software that supports multiple currencies while performing tax calculations together with robust reporting features.

Reliable invoice software investment by freelancers small business owners and enterprises leads to increased productivity alongside better organization and higher client satisfaction. Your billing operations will run efficiently after choosing software solutions that support your company’s requirements.

FAQs

1. Where should small businesses start their search for invoice software?

Your business’s particular requirements determine which invoice software will work best for you. Small businesses often choose FreshBooks, Zoho Invoice, and QuickBooks because these platforms combine easy-to-use functionality with customizable document creation and cost-effective pricing options.

2. Should I view invoice software as a solution for handling recurring invoice generation?

Invoice software delivered by companies such as QuickBooks, FreshBook,s and Zoho Invoice brings automated recurring billing options that work nicely for businesses with subscriptions or clients under multi-month agreements.

3. Can users protect their money when they use invoice software to make online payments?

Invoice software connects users to safe payment platforms such as PayPal Strip and Square and executes transactions through encryption and protected security protocols.

4. Should I purchase additional software for accounting together with my invoicing software?

Invoice software normally incorporates basic accounting functions but enterprises typically obtain better financial management by combining invoicing software with accounting software such as QuickBooks or Xero for bookkeeping taxation operations.

5. Can invoice software systems handle tax computation?

Application of tax rules based on your location and business type is possible through numerous invoice software solutions which will automatically compute the accurate tax rates and prevent invoice compliance issues while saving time.