The management of employee wages remains vital for India-based organizations. The top payroll software in India provides advanced features to deliver precise compensation distribution alongside regulatory conformity and better workforce contentment. Software selection should be focused on simplicity, affordability, strict compliance features, scalability, and accounting system connection options.

The compilation of the 15 best payroll software in India features Zoho Payroll, GreytHR, Saral PayPack, Keka HR, HRMantra, RazorpayX Payroll, Spine Payroll, Beehive HRMS, SumHR, HROne, Pocket HRMS, ZingHR, factoHR, Marg Payroll, and Paybooks. The list consists of software designed to help HR professionals, payroll specialists, and accountants as well as business owners and developers who develop payroll systems to function optimally.

These solutions automate complex operations which decreases errors and heightens operational effectiveness to let organizations focus on their strategic expansion plans. Before diving into the detailing of payroll software in India, check out our guide on employee attendance tracker software.

Criteria for Selecting the Best Payroll Software in India

When selecting the top payroll software in India, some of the most crucial factors are:

- Regulatory Compliance: Indian regulatory compliance such as PF, ESI, PT, TDS, and other employee laws.

- Ease of Use: Simple to use and easy-to-use interface that makes it easy to process payroll for HR professionals, accountants, and entrepreneurs.

- Integration Capabilities: To integrate with the current HRMS, accounting software, and other business apps seamlessly.

- Affordability & Scalability: Moderately priced bundles that scale with your business, supporting small enterprises and multinationals as well.

- Customization & Flexibility: Configurability to define salary regimes, deductions, and perks by company rules.

- Data Security: Robust controls to guard personal employee data.

- Reporting & Analytics: Comprehensive auditing and planning aids to complement analysis and report design.

- Customer Support: Reliable aid and guidance mechanisms to simplify uncomplicated adoption and usage.

List of 15 Payroll Software in India

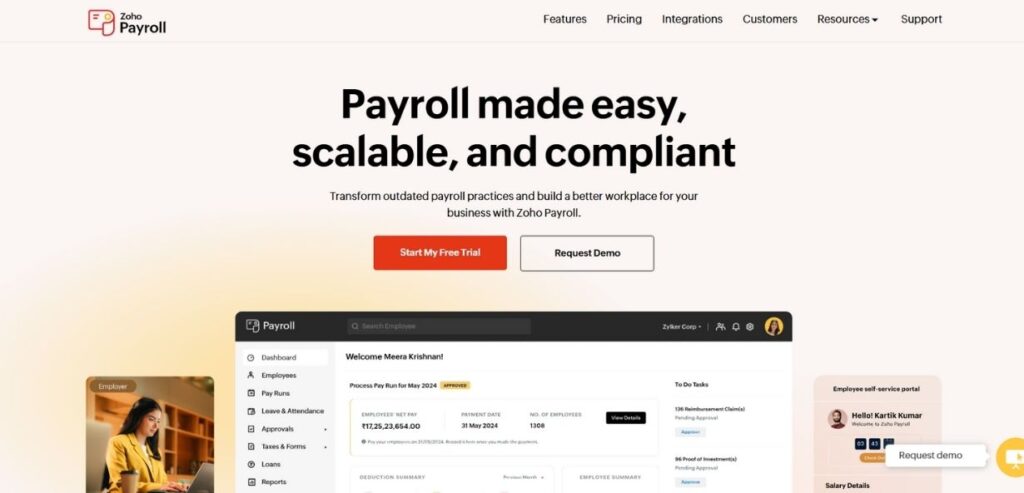

1. Zoho Payroll

Zoho Payroll is an online payroll software that can be used by small and medium businesses in India. It calculates payrolls, tax deductions, and direct deposit of salaries automatically and ensures compliance with Indian regulations like PF, ESI, PT, and TDS. It offers an employee self-service for payslips and tax certificates. It is very easily integrated with Zoho’s ecosystem and other third-party applications. Zoho Payroll is affordable and easy to implement, which makes it a great choice for businesses that want a no-fuss, reliable payroll option.

Key Features:

- Automatic payroll processing and tax calculations

- Direct deposit and employee self-service portal

- Statutory compliance (PF, ESI, TDS, PT)

- Customizable salary structures

Pros:

- User-friendly interface with seamless Zoho ecosystem integration

- Affordable for small and medium businesses

Cons:

- Limited integrations with non-Zoho tools

- Customization options can be restrictive

Pricing: Starts at ₹50 per employee per month

Who Should Use It? Small to mid-sized businesses looking for an affordable, cloud-based payroll solution.

2. GreytHR

GreytHR is a complete HR and payroll software solution for businesses of any size. It streamlines payroll processing, tax compliance, leave and attendance, and employee self-service. The system ensures statutory compliance with PF, ESI, PT, and TDS. It offers robust reporting and analytics tools to automate HR operations. GreytHR mobile app enables employees to view payslips, request leaves, and update data. With robust compliance capabilities and scalability, it is a choice of preference for Indian companies looking for an effective HR and payroll solution.

Key Features:

- Payroll automation with compliance management

- Employee self-service portal

- Leave and attendance tracking

- Reports and analytics

Pros:

- Strong compliance support for Indian labor laws

- Scalable for growing businesses

Cons:

- Interface could be more modern

- Some features are locked behind higher pricing tiers

Pricing: Starts at ₹3499/month for up to 50 employees

Who Should Use It? Businesses of all sizes needing compliance-heavy payroll management.

3. Saral PayPack

Saral PayPack is a small and mid-size business payroll management software. It calculates salaries, deducts taxes, and meets statutory requirements, such as PF, ESI, PT, and TDS. The software provides functionalities like generating payslips, leave tracking and attendance. It supports a basic and easy-to-use interface that makes payroll processing effortless for companies that do not have large HR staff. Saral PayPack can be used both as a desktop and cloud-based solution, so it is an adaptable option for companies seeking a low-cost payroll management solution.

Key Features:

- Payroll processing with salary structuring

- Compliance with PF, ESI, PT, and TDS

- Payslip and report generation

- Employee database management

Pros:

- Easy-to-use interface for non-tech users

- Cost-effective for small businesses

Cons:

- Limited cloud functionality

- Lacks advanced integrations

Pricing: One-time license pricing available (contact vendor)

Who Should Use It? Small businesses looking for an affordable, offline payroll solution.

4. Keka HR

Keka HR is a cutting-edge HR and payroll software with a sleek UI and AI-driven automation. It provides functionalities such as payroll processing, leave and attendance management, performance management, and employee self-service. Keka is compliant with Indian tax regulations and supports integration with accounting software. The mobile app of the software enables employees to view payslips and apply for leave. It is best suited for mid-sized to large enterprises that need an easy-to-use and full-featured HR solution that improves employee experience and streamlines payroll management.

Key Features:

- AI-powered payroll automation

- Employee self-service and mobile app

- Time tracking and performance management

- Integration with accounting and HR tools

Pros:

- Intuitive UI with excellent user experience

- Strong attendance and leave tracking features

Cons:

- Higher pricing for small businesses

- Learning curve for advanced features

Pricing: Starts at ₹6999/month for 100 employees

Who Should Use It? Mid-sized to large companies focusing on HR automation and employee engagement.

5. HRMantra

HRMantra is a robust HR and payroll management tool that automates salary processing, compliance, and performance tracking. It includes AI-based analytics, biometric attendance tracking, and an employee self-service mobile application. The platform guarantees statutory compliance with PF, ESI, and TDS, and therefore it is a safe choice for businesses handling large-scale workforces. HRMantra’s automated features and personalization attributes make it ideal for companies that want an end-to-end HR platform that can automate payroll, employee engagement, and administrative functions with ease.

Key Features:

- Payroll automation with statutory compliance

- AI-powered analytics and reporting

- Performance and leave management

- Mobile app for employees

Pros:

- Comprehensive HR and payroll solution

- Strong reporting and analytics

Cons:

- Expensive for small businesses

- Slightly complex UI for beginners

Pricing: Custom pricing (contact vendor)

Who Should Use It? Large businesses with complex HR needs.

6. RazorpayX Payroll

RazorpayX Payroll is a cloud payroll solution suited for startups and SMEs. It processes payrolls, taxes, and disbursals automatically and ensures that PF, ESI, and TDS rules are complied with. It has a payment gateway integration with RazorpayX that allows for free bank transfers and employee benefits tracking. The tool is simple to install and supports a free startup plan. With its unique emphasis on automation and financial integration, RazorpayX Payroll is a perfect solution for digital-native businesses seeking an effective payroll solution.

Key Features:

- Automated payroll processing

- Direct bank transfers with RazorpayX integration

- Compliance management (PF, ESI, PT, TDS)

- Employee benefits and insurance integration

Pros:

- Seamless integration with Razorpay payments

- Free plan available for startups

Cons:

- Limited advanced HR features

- Dependency on Razorpay ecosystem

Pricing: Free for startups; paid plans start at ₹100 per employee per month

Who Should Use It? Startups and small businesses using Razorpay for payments.

Here’s the continuation of the list:

7. Spine Payroll

Spine Payroll is a streamlined payroll management software meant for Indian enterprises. It includes automated payroll processing, compliance handling, attendance monitoring, and generation of payslips. The software is compliant with statutory regulations for PF, ESI, and PT and makes tax filing easy. It offers in-depth reporting and has integration with accounting software. Spine Payroll is a low-cost, user-friendly solution for small and mid-sized companies requiring a trustworthy, locally oriented payroll system without any unnecessary complexity.

Key Features:

- Automated salary calculation

- Statutory compliance (PF, ESI, PT, TDS)

- Leave and attendance management

- Payslip and report generation

Pros:

- Affordable and easy to use

- Good compliance support for Indian businesses

Cons:

- Limited integration with third-party tools

- UI could be more modern

Pricing: Contact vendor for pricing

Who Should Use It? Small and mid-sized businesses need a budget-friendly payroll solution.

8. Beehive HRMS

Beehive HRMS provides an entire HR and payroll management solution that serves organizations at mid-sized to larger scales. The software executes payroll tasks along with tax deduction responsibilities and regulatory compliance procedures and links all HR operations including personnel leave management and performance assessment and recruitment. Employees can access services through the mobile application and perform self-service activities enabled by AI analytics features. The tool Beehive HRMS matches the business requirements of mid-sized and large enterprises that need a unified system to both raise HR efficiency and achieve accurate payroll handling with Indian regulatory compliance.

Key Features:

- Payroll automation with tax compliance

- Employee self-service portal

- Performance management and appraisals

- Leave and attendance tracking

Pros:

- Scalable for growing businesses

- Strong HR and payroll integration

Cons:

- Initial setup takes time

- Slightly expensive for startups

Pricing: Custom pricing (contact vendor)

Who Should Use It? Mid-sized and large companies looking for a complete HRMS solution.

9. SumHR

SumHR is a cloud-based payroll and HR software committed to startups and small-medium-sized organizations. The software offers automated payroll services compliance tools for staff management self-service functionality for employees and attendance tracking functionalities. PF ESI and TDS statutory compliance along with accounting system integration are aspects of this software. The cost-effectiveness along with ease of use of SumHR makes it ideal for small companies who wish to streamline their payroll process and become compliant with regulations.

Key Features:

- Automated payroll with compliance support

- Employee self-service and document management

- Attendance and leave tracking

- Integration with accounting tools

Pros:

- Simple UI and easy setup

- Good support for startups and SMEs

Cons:

- Limited customization options

- Mobile app experience can be improved

Pricing: Starts at ₹49 per employee per month

Who Should Use It? Startups and small businesses needing an easy-to-use payroll solution.

10. HROne

HROne is an HR and payroll software with extensive features for mid-size and large companies. It has payroll automation, tax compliance, AI-based analytics, and employee engagement functionalities. The platform comes with a chatbot for HR-related queries, a mobile application, and performance management. HROne automates payroll functions while providing an improved employee experience. Being highly scalable and advanced in terms of automation, it is a perfect solution for firms seeking an integrated HRMS.

Key Features:

- Payroll automation with tax compliance

- AI-powered chatbot for HR tasks

- Employee engagement and feedback tools

- Mobile app with employee self-service

Pros:

- Strong automation and AI features

- Good customer support

Cons:

- Higher pricing for small businesses

- Some users find UI slightly complex

Pricing: Custom pricing (contact vendor)

Who Should Use It? Mid-sized and large businesses looking for an all-in-one HR solution.

11. Pocket HRMS

The cloud-based payroll and HR software Pocket HRMS provides AI-powered automation features to its users. The software solution provides a full range of services that include payroll processing together with tax compliance features leave tracking abilities and employee self-service capabilities. The software solution has both an AI/chatbot for handling HR inquiries and a mobile application for users who need to access the system on the move. The system helps organizations maintain correct adherence to Indian labor legislation while connecting with accounting systems. Businesses of medium to large scale should consider Pocket HRMS as their intelligent payroll and HR solution because of its automated features.

Key Features:

- AI-based payroll and tax compliance

- Employee chatbot for HR queries

- Attendance and performance management

- Mobile app for self-service

Pros:

- AI-powered automation saves time

- Good compliance support

Cons:

- Pricing may be high for startups

- Some reports need improvement

Pricing: Custom pricing (contact vendor)

Who Should Use It? Mid-sized and large businesses looking for AI-powered payroll automation.

12. ZingHR

ZingHR provides entities with an AI-driven payroll and HRMS platform delivered through the cloud that automates functionalities and generates insights. ZingHR provides an all-inclusive platform that includes functions for payroll processing tax compliance performance management and recruitment tools. The mobile application provided by ZingHR allows workers to view their payslips while also handling vacation requests. The product provides robust automation capabilities together with regulatory conformity assistance making it suitable for organizations that need technology-based human resources and payroll solutions.

Key Features:

- Payroll automation with compliance management

- AI-powered analytics and reporting

- Recruitment and performance management

- Employee self-service via mobile app

Pros:

- Strong HR and payroll automation

- Good analytics and reporting

Cons:

- Slightly complex for small businesses

- Customization options can be limited

Pricing: Custom pricing (contact vendor)

Who Should Use It? Mid to large enterprises focusing on HR automation and compliance.

13. factoHR

The scalable payroll and HR software aktuHR serves businesses ranging from small to medium-scale operations. The system eliminates human labor by handling payroll procedures and attendance recordkeeping while ensuring investigations of Indian tax standards. The factoHR platform offers mobile accessibility while supporting connections to accounting software because it stands out as an affordable option for businesses that need effective payroll management solutions.

Key Features:

- Automated payroll processing

- Attendance and leave tracking

- Mobile app with employee self-service

- Compliance with PF, ESI, PT, and TDS

Pros:

- Affordable and scalable

- Good customer support

Cons:

- UI can be improved

- Some integrations require manual effort

Pricing: Starts at ₹20 per employee per month

Who Should Use It? SMEs and mid-sized businesses looking for a cost-effective payroll solution.

14. Marg Payroll

The cost-effective Marg Payroll software offers payroll features that are specifically designed for organizations with less than thirty employees. The users benefit by processing wages along with tax compliance and attendance monitoring while getting automatic payslips through the system. The software is fully compliant with employment laws regarding PF, ESI, and TDS. The Marg Payroll system is used by small businesses that require a low-cost basic payroll solution to automatically process wages and meet tax obligations.

Key Features:

- Payroll processing with tax calculations

- Employee attendance and leave management

- Statutory compliance (PF, ESI, PT, TDS)

- Reports and analytics

Pros:

- Budget-friendly for small businesses

- Easy-to-use interface

Cons:

- Limited cloud functionality

- Basic features compared to competitors

Pricing: Contact vendor for pricing

Who Should Use It? Small businesses looking for an affordable payroll solution.

15. Paybooks

Paybooks is a cloud-based payroll software used to automate the processing of salaries, tax compliance, and the generation of payslips. It comes with integration in accounting tools as well as having an employee self-service portal. The software takes care of the statutory compliance requirements of PF, ESI, and TDS, thus enabling hassle-free filing of taxes. With a user-friendly interface and affordable pricing, Paybooks suits small and medium-sized businesses looking for a reliable payroll solution.

Key Features:

- Automated payroll with compliance management

- Employee self-service and mobile app

- Integration with accounting software

- Leave and attendance tracking

Pros:

- Easy to set up and use

- Strong compliance support

Cons:

- Limited advanced HR features

- Customer support can be improved

Pricing: Starts at ₹1499/month for 10 employees

Who Should Use It? Small and mid-sized businesses need a simple cloud-based payroll solution.

Comparison Between Different Payroll Software

Below is a comparison table summarizing key aspects of each payroll software:

| Software | Key Features | Pricing | Use Cases | Website |

| Zoho Payroll | Automated payroll processing, tax compliance (PF, ESI, TDS, etc.), employee self-service portal, and seamless Zoho ecosystem integration. | Starts at approximately ₹50/employee/month | SMEs and small businesses looking for cloud-based payroll automation. | zoho.com/payroll |

| GreytHR | Comprehensive HR & payroll management, automated payroll, statutory compliance, leave & attendance management, and robust reporting. | Starts at around ₹3495/month (for up to 50 employees) | Businesses of all sizes that need strong compliance and HR management. | greythr.com |

| Saral PayPack | Payroll processing with salary structuring, statutory compliance (PF, ESI, PT, TDS), payslip generation, and simplified user interface. | Custom pricing – contact vendor | Small businesses preferring an affordable, sometimes offline, payroll solution. | saralpaypack.com |

| Keka HR | Modern HR and payroll platform with AI-powered automation, employee self-service, attendance tracking, and performance management. | Starts at approximately ₹9999/month (for 100 employees) | Mid-sized to large companies focused on comprehensive HR automation. | keka.com |

| HRMantra | Robust HRMS with payroll automation, compliance management, performance tracking, AI-powered analytics, and biometric attendance features. | Custom pricing – contact vendor | Large enterprises with complex HR and payroll requirements. | hrmantra.com |

| RazorpayX Payroll | Cloud-based payroll solution offering automated processing, direct bank transfers, statutory compliance, and integration with Razorpay’s ecosystem. | Free for startups; paid plans start at ₹100/employee/month | Startups and small businesses leveraging digital payments. | razorpay.com/payroll |

| Spine Payroll | Automated payroll processing, compliance management, attendance tracking, and payslip generation with a focus on simplicity and affordability. | Custom pricing – contact vendor | Small to mid-sized businesses seeking a cost-effective payroll solution. | spinetechnologies.com |

| Beehive HRMS | All-in-one HRMS featuring payroll automation, attendance & leave management, performance tracking, AI analytics, and a mobile self-service portal. | Custom pricing – contact vendor | Mid to large enterprises looking for an integrated HR and payroll platform. | beehivesoftware.in |

| SumHR | Cloud-based payroll and HR software with automated processing, employee self-service, attendance tracking, and statutory compliance features. | Starts at approximately ₹49/employee/month | Startups and SMEs needing an easy-to-use, online payroll solution. | sumhr.com |

| HROne | Full-featured HRMS offering payroll automation, tax compliance, performance management, an AI chatbot, and mobile access for HR tasks. | Custom pricing – contact vendor | Mid-sized and large companies requiring comprehensive HR management. | hrone.cloud/payroll-software |

| Pocket HRMS | Cloud-based HRMS with payroll automation, leave and attendance management, AI-driven features, and a mobile app for employee self-service. | Custom pricing – contact vendor | Mid to large businesses looking for automation-driven HR and payroll solutions. | pockethrms.com |

| ZingHR | Cloud-based HR & payroll management with AI-powered analytics, recruitment, performance management, and statutory compliance tools. | Custom pricing – contact vendor | Enterprises seeking advanced HR automation and insightful analytics. | zinghr.com |

| factoHR | Automated payroll processing, attendance tracking, compliance with Indian tax laws, and mobile integration for real-time updates. | Starts at approximately ₹20/employee/month | SMEs and mid-sized businesses desiring a cost-effective payroll system. | factohr.com |

| Marg Payroll | Payroll management with salary processing, statutory compliance (PF, ESI, TDS), attendance & leave tracking, and basic reporting capabilities. | Custom pricing – contact vendor | Small businesses looking for a budget-friendly, straightforward payroll solution. | margerp.com |

| Paybooks | Cloud-based payroll software featuring automated payroll processing, tax compliance, payslip generation, and seamless integration with accounting tools. | Starts at approximately ₹2499/month for 30 employees | Small to mid-sized businesses in need of a simple, reliable payroll system. | paybooks.in |

Conclusion

In summary, payroll software in India address different business requirements with diverse features, pricing, and compliance capabilities. Small businesses seeking ease and affordability use Zoho Payroll, Saral PayPack, and Marg Payroll. Mid-sized businesses use GreytHR, SumHR, and Keka HR with high compliance and scalability. Large businesses with complex HR needs use HRMantra, Beehive HRMS, and Pocket HRMS with improved analytics and customizations.

Tech companies and start-ups can implement RazorpayX Payroll effortlessly to provide smooth digital integration. Select the most apt payroll software based on company size, budget, and operational requirements. Ideally, the solution takes the processing of payroll on automation mode, enhancing compliance, and increasing overall efficiency to allow the company to target strategic growth. Invest wisely and let future success break free.

FAQs

1. What is payroll software?

Payroll software is a computerized automatic system that performs the salary calculation, payment, and statutory contribution (PF, ESI, and TDS) of employees. It renders the task of payroll simple, reduces errors, and restricts administrative costs, thereby making salary management efficient for enterprises of any size.

2. Why is payroll software compulsory for Indian enterprises?

Payroll software guarantees timely and precise payment of salaries, ensures compliance with Indian labor regulations, and reduces the possibility of human errors. It is time-saving, reduces operational expenses, and enables HR departments and accountants to engage in strategic work instead of computations.

3. What are the major features to look out for?

Some of the major features include self-pay computation, tax compliance, employee self-service websites, HR and accounting software integration, configurable compensation structures, report reporting in real-time, as well as security functions for information.

4. In how many ways is payroll software following Indian legislation?

The software undergoes regular maintenance to comply with current government decrees and workers’ legislations, automatically calculating PF, ESI, PT, TDS, and statutory contributions and deducting accordingly. This saves businesses from legal repercussions and maintains accurate records for audits.

5. How do I select the appropriate payroll software in India for my business?

Choose payroll software that suits your business size, budget, and specific needs like ease of use, scalability, integration, and support. Determine if you require a cloud-based or on-premise solution and utilize free trials to test the functionality of the software before purchasing.